The State of Airport Privatizations:

Cautious Optimism on the Horizon

Written by: Michael Tubridy and Brian Poe of Landrum & Brown Americas; David Miles and Ian Guy of Landrum & Brown Asia Pacific.

Throughout 2020 and the first quarter of 2021, COVID-19 brought travel and most of the airport Public-Private-Partnership (PPP) market to a screeching halt. However, there are positive signs the PPP market is ready for a rebound. This article explores the current state of airport PPPs world-wide and what could be on the near-term horizon as we emerge from the grips of COVID-19.

In 2019, according to a survey completed by the industry group Airport Council International (ACI), almost 45% of the world’s passenger traffic was served by privately operated airports with Europe (at 75%) and Latin America (at 66%) leading the way. The ACI survey also indicates 45% of Asia-Pacific Airports are operated by private Investor-Operators. The remaining regions of the world, including North America, and specifically the US are not convinced by the benefits of Airport PPPs. For the purposes of this article, airport PPPs refer to the operation, maintenance and capital development of an entire airport facility over a specified (long-term) lease term.

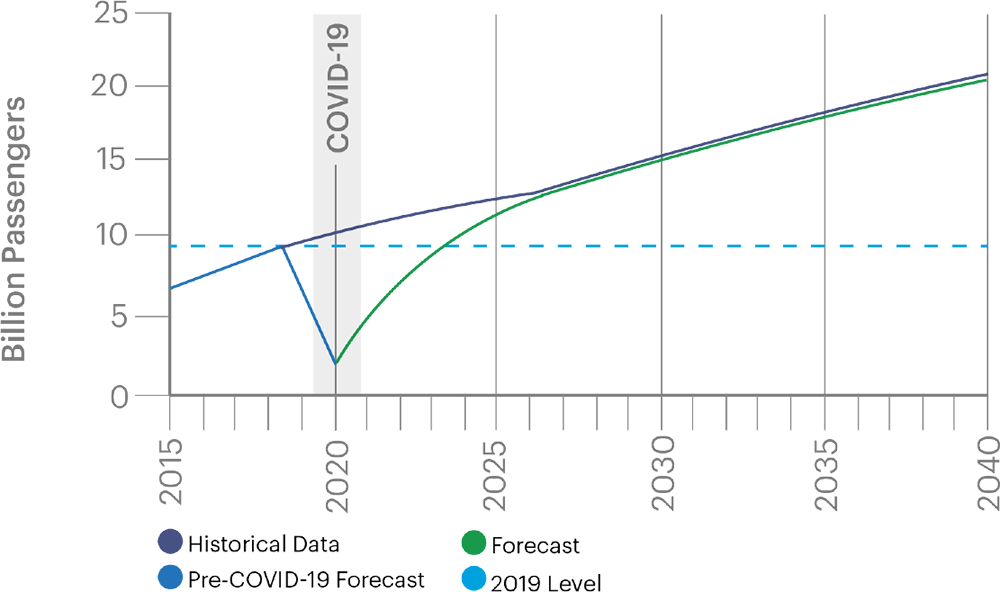

L&B together with industry organizations such as ACI predict that the world’s air traffic will fully recover from the effects of COVID-19 by 2023-24 (including domestic and international traffic) with the domestic markets recovering even more quickly. Within the next 20 years (by 2041), passenger traffic will double from 9 billion pre-COVID-19 passengers to almost 20 billion passengers in 2040.

Percent of Privatized Airport by Passenger Totals

Source: ACI; Landrum & Brown adaptation

Estimated Rate of Recovery from COVID

Source: ACI, June 2021; Landrum & Brown adaptation

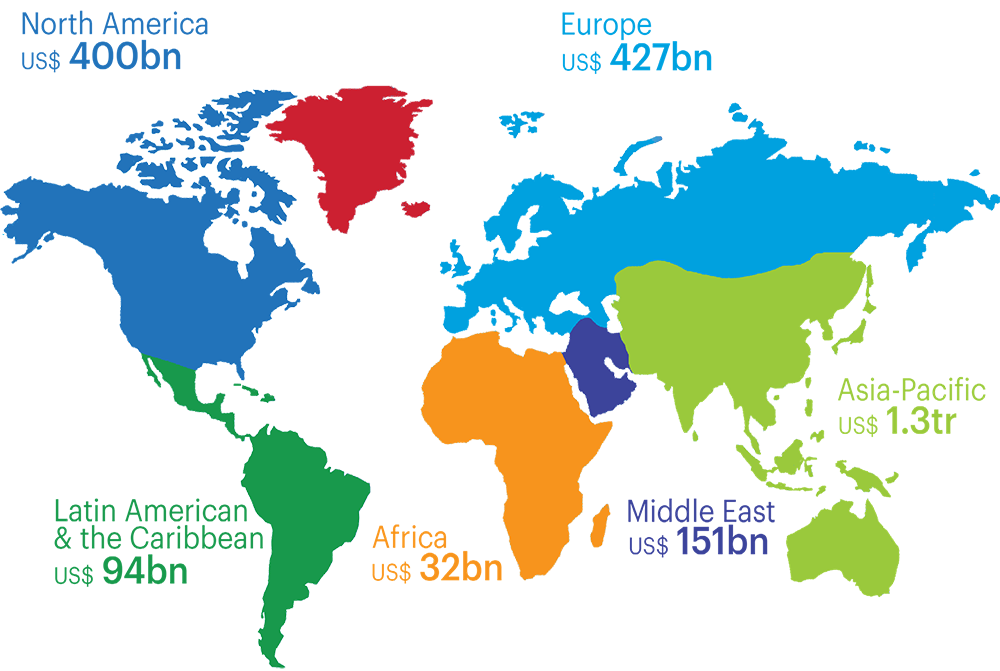

As aviation traffic resumes growth, the shortfall in infrastructure investment will be staggering. The predicted level of investment needed to accommodate future passenger demand and maintenance of airport facilities worldwide is estimated to exceed $1.7 trillion over the next 20 years. How is this level of investment going to be funded? Historically, governments have financed the vast majority of existing airport infrastructure. COVID-19 has placed an immense burden on every aspect of global aviation and generally increased the debt burden of nations. While governments and communities focus their efforts on health services and economic recovery, airports are still facing massive expenditure requirements with limited revenue and little support from many governments.

Many private airport investors-operators in developing nations are not only suffering from lost passenger traffic due to the COVID-19, but many governments are also relying on the private investor-operators to continue to pay annual concession payments; many of which are not directly tied to traffic levels. These payments are being used to offset government expenditures in other areas of government.

It is possible in the short-term private investor-operators will direct their capital towards other types of assets much less affected by the pandemic and more sustainable in the current context. However, private investors indicate a willingness to invest in airports as soon as COVID-19 is stable and traffic levels become more predictable. It is also clear that their current and short-term priorities are more focused on defending their interests in existing concessions, securing their financial situation, and implementing health recommendations.

This indicates that in the short-term and in the context of traffic resumption, the airport PPP market could take two or more years to recover and regain the confidence of investors and financers.

The only exceptions to this scenario are airports with high domestic or regional traffic in large countries or areas with a significant volume of tourism and existing government policy framework or legislation in place to enable private sector investment. The early trends of 2021 seem to support this.

Given the unusual events of the past year and a half, traditional investment and risk sharing models in the future will need to change and become more creative if investment in airports is to continue in a fair and equitable manner to both the private and public sector.

Global Capital Needs (2021-2040)

Source: ACI, June 2021; Landrum & Brown adaptation

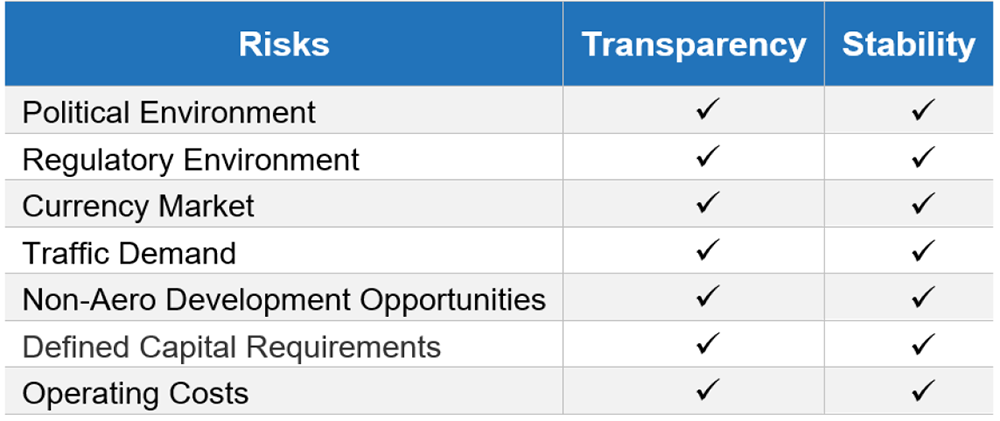

For example, light-handed regulation could be implemented where there is transparency and stability in the region. Concession fees paid by the private investor should be based solely on traffic demand. Similarly, capital projects could be implemented on the basis of specific traffic demand triggers. Market-based airport improvement fees (AIF) or passenger facility fees (PFC) to fund capital projects could also be implemented. These models must also address climate change in ways they have not done so in the past.

Balancing the Risks between Private Investor-Operator and Government Operators

Private investor-operators are becoming more sophisticated in understanding the risks, as well as, the potential upside to airport PPP opportunities. There are numerous risks to private investor-operators, which must be analyzed during the due diligence stage of an airport PPP opportunities.

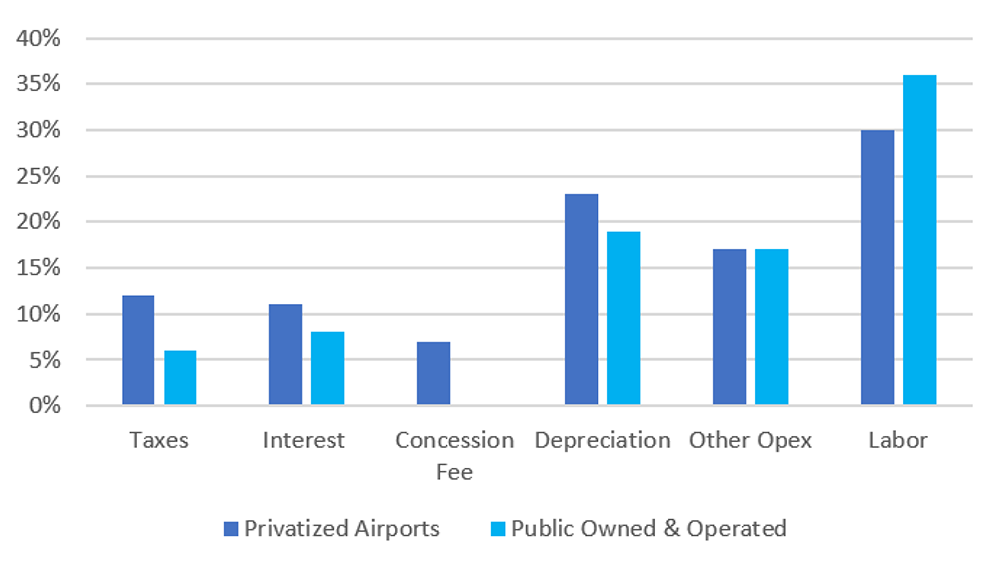

Managing these risks are critical to successful airport PPPs. For example, understanding operating costs at the due diligence phase of a prospective airport PPP is critical in evaluating the potential return on investment. Operating costs are uniquely different at airports with private investment.

Source: Landrum & Brown

The cost of capital and other fixed costs tend to be greater as a percentage of operating costs for privately operated airports.

One reason for this is private airports must rely mainly on capital markets; they must finance capital investments by issuing debt to finance capital project or operating expenses.

While publicly owned airports can access funds in a similar manner, they may also draw on governments to finance capital projects, or they issue public debt that is tax exempt.

Additionally, private airports must pay concession fees that publicly operated airports do not pay. However, private operators in many cases have the ability to control the procurement and scheduling of large capital projects in ways that are not available to the public operators.

On average, taxes and direct fixed costs represent roughly 35% of total airport costs for fully government owned and operated airports. These costs can be in excess of 50% for airports that have some form of private stake. However, labor and contracted related costs are less at private airports due in part to their ability to streamline and control operational efficiencies in ways that public airports may not. For example, private operators can negotiate with operations and maintenance contractors for labor and equipment and are not typically bound by the procurement rules and regulations of governments.

Airport PPP opportunities will continue to be of interest to private investors-operators as long as the potential upside they bring will be reflected in appropriate returns on investment. Their strength is often their ability to grow non-aeronautical revenues, optimize airport operations, and develop cost effective capital projects. In these uncertain times, if governments require private investment in airports, they must create an environment that is equitable.

For example, by providing short term financial relief to private investors in the form of waiving fixed concession fees for a period of time, or delaying time-based capital projects, or structuring viability gap funding for optimum balancing of public and private risk, or developing a new model where governments and private investor-operators share aviation traffic risk.

Fixed Costs as a Percentage of Total Operating Costs (by Type of Ownership)

Source: ACI, 2020 Key Performance Indicators

Cautious Optimism for Airport PPPs – Where?

Prior to COVID-19, the early part of 2020 indicated a consistent level of interest in airport PPPs around the world. However, since then, most of these were put on hold. During the second quarter of 2021, there are early signs of momentum primarily in the Latin American-Caribbean and Asian regions. It remains to be seen if new airport PPPs will reflect a new form of risk sharing, and how that may impact the timing of these transactions.

Many governments will emerge from the pandemic with reduced resources and ever-present infrastructure investment needs. Airport PPPs will become more necessary in many places to ensure the ongoing supply of investment in airport infrastructure.

In view of the difficult conditions that private investor-operators have had to face with governments and banks to properly enforce protections offered in their PPP agreements, a relaunch of the airport PPP market can be possible only if governments ensure that future airport PPP models improve. The key is the ability and willingness to enforce protections and prevent the impact of new similar crises while ensuring an appropriate risk share.

Specific areas within Latin America – Caribbean, Asia, and to a lesser extent in African regions, are geographies where private investors are likely to focus their efforts on new airport PPP opportunities within the next year or two. In Europe, there do not appear to be any major European airports to be privatized within the next year or two.

The focus of the upcoming airports to be privatized is likely from a more rapid and lasting return to growth thanks to a strong and growing tourism travel market.

In the Latin America – Caribbean region, most of the airport privatizations from 2020 were in the preliminary stages of development but were put on hold. There are only a few upcoming transactions in the works for 2021 and 2022, including regional airports in Chile, the 7th group of regional airports in Brazil as well as a number of state airports, the international airport in Barbados and a small group of airports in the Bahamas. Brazil represents the most active and largest country implementing airport privatizations.

Since 2011, it has consistently and almost annually transferred its major airports in staged concession auctions to private investment.

The Government of Brazil remains committed to transfer its remaining federal airports to the private sector. In 2022, a 7th group of airports will be broken down into three blocks, with the Santos Dumont Airport and the Sao Paulo Congonhas Airport as the remaining large airports. In 2020, there was little PPP activity in Asia-Pacific and African regions.

Highlights of potential PPP activity in the latter half of 2021 and into 2022 includes the following:

- India – the second airport in Delhi, as well as, up to 20 regional airports

- Japan -numerous airports underway including Hiroshima Airport

- Indonesia – Lombok Airport

In a number of other Asian countries there remains a desire to privatize airports, but progress is sporadic. A recent study by L&B indicates that support from multilateral institutions on transactional guidance and funding throughout Asia could improve the appetite for airport PPPs. It also appears that governments in Nigeria are starting to take airport privatization more seriously, and we may see privatizations emerge in Lagos and Abuja within the next year or two.

Where does the U.S. fit in terms of the Airport PPP Market – post COVID-19?

When the U.S. Congress established the Airport Investment Partnership Program (formerly Airport Privatization Pilot Program) in 1997, it did so with the intent of exploring privatization as a means of generating access to various sources of private capital for airport improvement and development. For a variety of reasons, the use of this program has been uneven at best, with a number of airports entering the program only to exit after the preliminary due diligence phase.

There are only a few small airports remaining in the program and none that appear to be privatization-ready in 2021.

The Luis Munoz Marin International Airport in Puerto Rico is the primary example of a full airport privatization whereby the private investor-operator becomes the landlord for all the assets on the airport and is responsible to manage and develop the facilities as needed over the life of the lease deal.

To-date, privatization appears to be successful for both the Puerto Rico Ports Authority and the private investor-operator. While there are other examples in the U.S of partial airport privatizations, which include passenger or cargo terminals but not airfield facilities or entire airports.

Historically, U.S. airports have been well-funded at the regional and National levels, benefit from tax exempt debt financing, and operate with a reasonable sense of financial stability. The recent 2020 CARES Act has provided a financial lifeline to almost every U.S. airport with passenger traffic. The Act has assisted the airports in remaining open and operational during COVID-19.

A reasonable question for U.S. airports in a post-COVID-19 world is whether or not the time has come for U.S. airports to fully endorse the concept of greater private sector investment and whether it is seen as advantageous to the surrounding communities.

With the growing need for new injections of capital, alternative funding sources, and alternative models of infrastructure implementation; it might be time for communities to seek and benefit from greater private investment, especially since domestic traffic levels are likely to recover by 2023 and international traffic levels to recover a year or two later.

One could argue the biggest impediment to airport PPPs in the U.S. is the heavy influence that airlines wield over capital programs, the inability of airports to implement market based passenger facility charges (PFCs) and the political interest that airports create, particularly when it comes to awarding large contracts for infrastructure development programs.

Private sector investors, especially investment banks and pension funds, are seeking new investment opportunities. As airports and local communities are still recovering from the financial struggles of the past year and a half, a convergence of interest between the private sector and public owners of airports is around the corner.

Conclusions

While the impacts that COVID-19 have had on airports and the relative uncertainty of when traffic will fully recover to 2019 levels is still unknown, governments and private investor-operators alike will be significantly more cautious about airport PPPs. Additionally, the global airport PPP market will likely be less active than in past years.

Additionally, new airport PPP models will likely be needed in the future to ensure a balance of risk between the public and private sectors.

Further complicating matters, every government has its own unique reason for privatization in the first place. It is not a one-size-fits-all approach, and airport PPPs must be created to address the specific needs of each community.

New airport PPP structuring will need to consider alternative approaches that address the following:

- Improved levels of service with airport operations

- Access to capital including desired terms and conditions

- Speed and efficiency of capital project implementation

- Increased non-aeronautical development and revenues

- Flexibility in the contractual concession agreements

- Market based fees when airports are located in transparent and stable countries

While airport PPP transactions might be scarcer in 2021, it is an ideal time for governments to rethink and explore new forms and models of airport privatization.

What is the L&B LAB?

The LAB is Landrum & Brown’s research and development unit. Our mission is to harness decades worth of industry knowledge and expertise to develop innovative solutions that support our clients along with promoting industry thought leadership.

This document was prepared by Landrum & Brown, Inc. | [email protected]

Sign up to receive our next L&B LAB in your inbox!