It was just over 100 days ago that Rob Adams was elevated to be L&B’s new president. Rob is only the fourth individual to lead L&B since it was founded in 1949. He brings to his new role an extensive knowledge of aviation, L&B’s institutional history, and strong industry relationships fostered over a career spanning more than 30 years. We are excited to work with Rob and to see where he takes L&B in the future. To that end, this LAB is different from our past posts. It will look back at the LAB’s inception and our industry’s recent past, provide an assessment of the current state of the industry and discuss where we believe the aviation industry and LAB might be going next. It will also include some insights and thoughts from Rob interspersed throughout the post.

“Creating the LAB was a first for L&B. We didn’t have a public newsletter or blog. The pandemic was an unprecedented event, and the vision for this LAB was our best means to engage the broader industry and our clients. We wanted to share our knowledge and do what we could do to help.”

Rob Adams, President

The Pandemic & the LAB (Past)

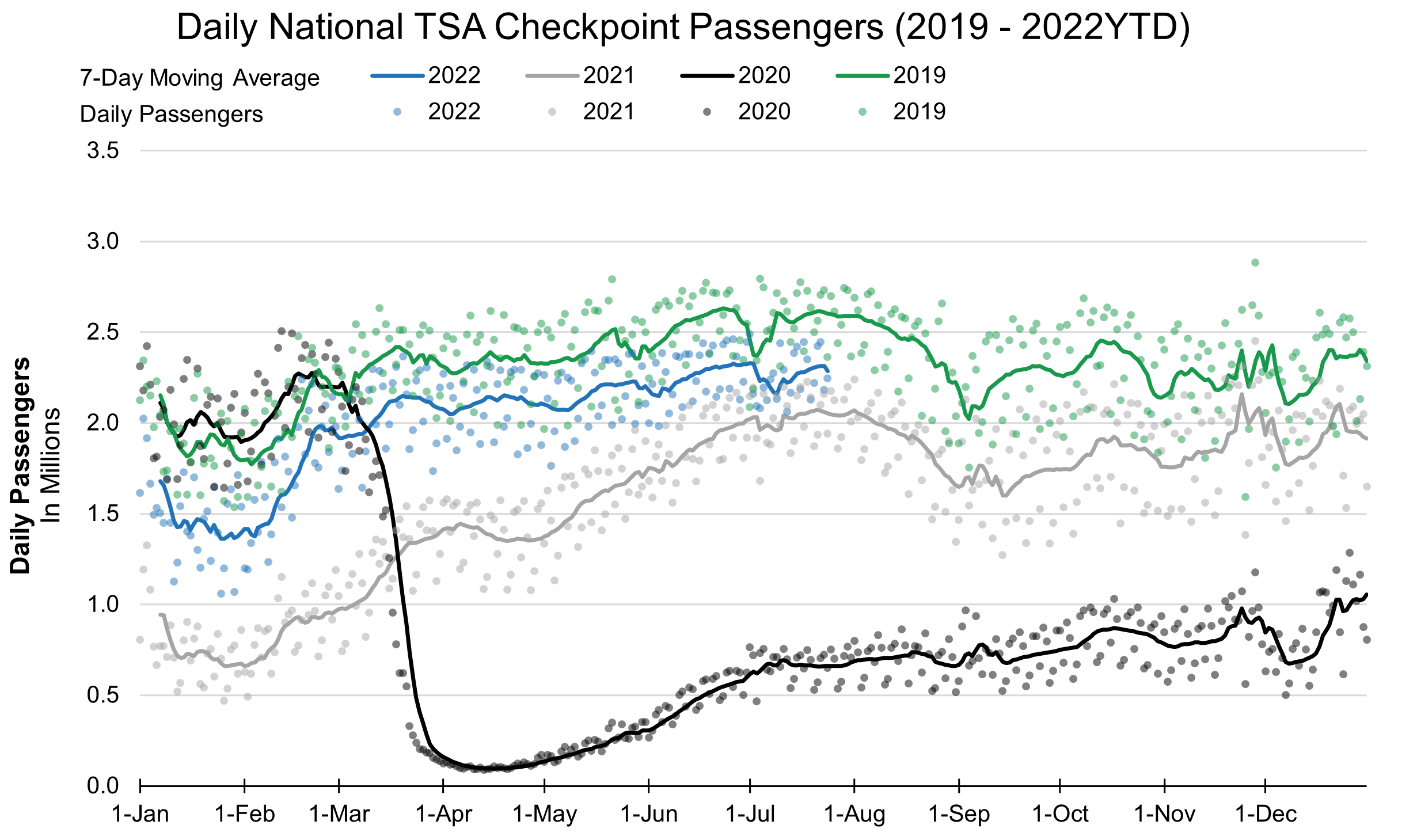

The L&B LAB was launched a month before the Pandemic was in-full-force and affected most of the United States (U.S.) in March of 2020. The impact on our industry was nothing but catastrophic. Not since 9/111 had we seen the demand for air travel decline so rapidly. However, unlike 9/11, this decline persisted through much of the following 12 months with gradual recovering occurring in 2021. The LAB (formerly called the Weekly) was launched at the beginning of this decline. Many of the articles during this time focused on the impact of COVID-19 on travel and when demand for flying might return. We examined this topic several times that year, as well as in 2021. The LAB team also explored various ways our clients might adapt to the pandemic, including recommended actions to adapt their facilities to support health screenings and provide more space for passengers to socially distance. As it became clear that we were entering a new phase of the pandemic (an endemic), the LAB’s focus became broader than this one crisis. The LAB started to explore areas of thought-leadership such as resiliency planning, advanced air mobility(AAM), customer demographics and terminal design, among others.

Source: Transportation Security Administration and L&B analysis

“It was clear as the pandemic endured the L&B LAB had more to say. As our industry has emerged from the pandemic, it is now facing a new series of challenges that will test its ability to adapt and be nimble.”

Rob Adams, President

State of the Industry, Current Assessment (Present)

COVID-19 pandemic is hopefully growing distant in the rear-view mirror as more and more countries shift their public health strategies from controlling a pandemic towards managing an endemic disease. Endemic disease management acknowledges that a disease is still around and may even be widespread. However, rather than focused monitoring of infection rates and testing, public health agencies now focus on evaluating hospital admissions rates and percent of staffed hospital beds occupied by COVID-19 patients. The U.S. CDC uses these as primary metrics to determine whether an area’s risk level is judged low, medium, or high2. So long as vaccines, treatments, and natural immunity continue to largely prevent serious disease that requires extended hospitalization, public health agencies will continue using an endemic management strategy that places few restrictions on travel and commerce.

Source: https://www.hospitalitynet.org/opinion/4103074.html

Source: Oxford COVID-19 Government Response Tracker, Blavatnik School of Government, University of Oxford

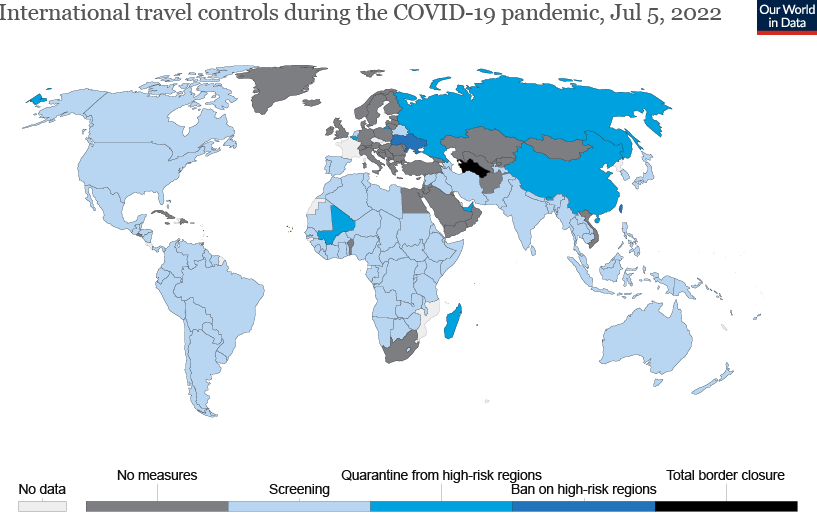

Most countries have eased border restrictions for COVID-19. As shown on the left, 61 countries have no travel restrictions based on COVID-19 status. Many of these countries are in Eastern Europe plus the United Kingdom, Italy, and Portugal, with the rest scattered around the globe. The largest travel markets among these countries are Mexico and Australia.

Many other countries have eased their restrictions, especially for their own citizens and permanent residents. As shown on the map, only two very large travel markets, China and Japan, have maintained their highly restrictive entry policies. Four others, Germany, India, Saudi Arabia, and New Zealand, still maintain many restrictions while eliminating some others.

“Eliminating or easing border restrictions for COVID-19 is an essential first step towards restoring our air travel industry.

Rob Adams, President

Worldwide Travel Now at 69% of 2019

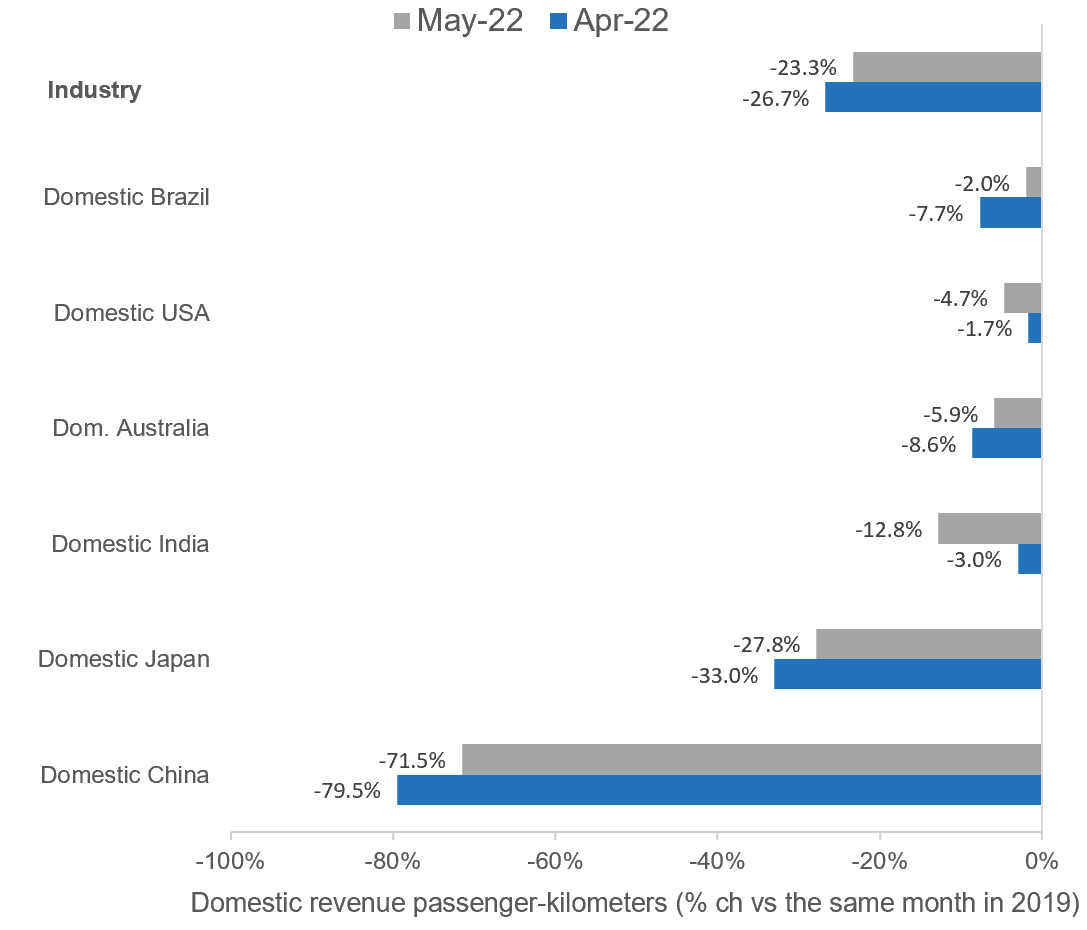

Outside of China the graph at right shows that domestic travel in large markets has nearly recovered to 2019 levels. Worldwide domestic travel in May increased to almost 77% of 2019. However, U.S. and India domestic travel recoveries appear to have peaked in April and travel recovery fell a bit in May. In the U.S., travel volumes had a seasonal increase, but the 2022 seasonal increases were less than the seasonal increase in 2019. In India, more restrictive travel policies and public perceptions of travel safety led to a sharp decline in May travel compared to April.

Source: IATA Economics, IATA Monthly Statistics

“I am encouraged to see international travel is returning. Over the course of the coming year, we hope the industry labor shortages start to resolve in line with traffic growth and that China will open its borders; both developments would help lock in a robust return to pre-pandemic travel.”

Rob Adams, President

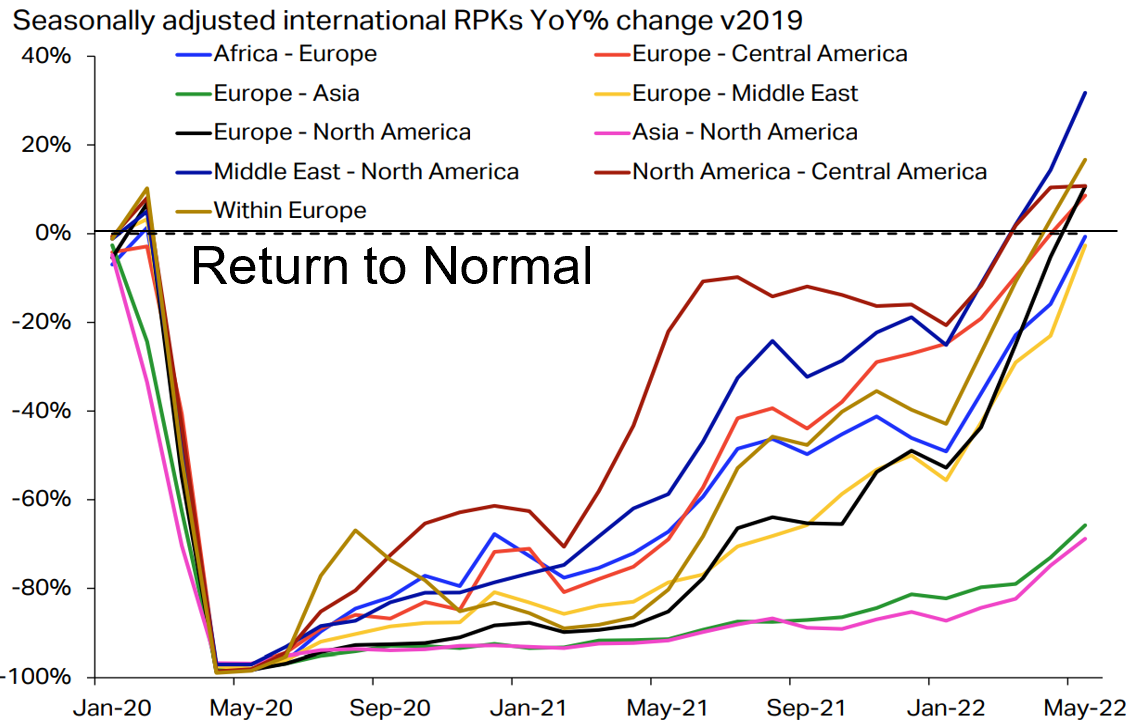

International Travel Across the North Atlantic and in the Middle East has Recovered

IATA statistics depict outside of Asia, major international travel markets have also recovered to their 2019 volumes. Chinese lockdowns are still dragging down international travel within Asia and across the Pacific. Travel volumes will continue their low volumes so as long as China pursues its “Zero COVID” pandemic management policy through massive testing programs followed by extended domestic and international travel lockdowns. The latest COVID variants are among the most transmissible viruses known. China will have a major challenge in succeeding to eliminate COVID-19 within their borders. Even if they succeed, opening borders to international travel remains unlikely in the foreseeable future under the Zero COVID policy when the rest of the world acknowledges COVID-19’s endemic status.

Source: IATA Monthly route area Statistics

Current Economic Headwinds for U.S. Airlines

U.S. airlines are focusing on two areas of concern that will limit their growth for the remainder of 2022 and into 2023. First, they have a shortage of pilots and other staff. The shortage of pilots was an issue prior to the pandemic. However, the pandemic induced a wave of early retirements and layoffs that has now exacerbated the previous shortage. Fixing the pilot shortage will take time.3 The major airlines are heavily tapping the large pool of qualified pilots that exists in their commuter airline partners. These commuter airlines, in turn, are turning to colleges and universities, in addition to traditional flight schools to create career pathways.4

Entry level pay has more than doubled. Major airlines have renegotiated their commuter airline partnership agreements to enable higher pay levels for their pilots. In addition to pilot shortages, the airlines and their partners, such as ground handlers, are also short staffed. They should be able to remedy these shortages more quickly than the pilot shortages. However, labor costs have increased due to the overall shrinkage of the U.S. labor supply. This issue is evident in most developed aviation markets globally, and it is hampering consumer confidence on flying.

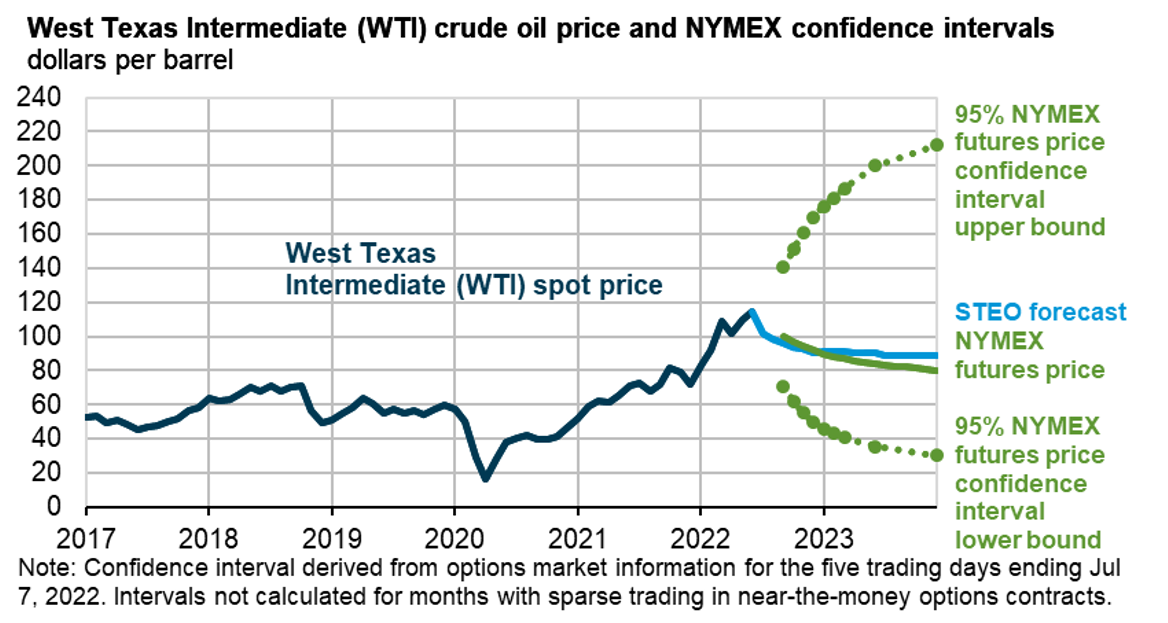

Next, fuel prices in May peaked at near record levels for two reasons. First is the embargo on Russian oil imposed as a result of the Ukraine war. Second, worldwide demand has increased in the economic recovery that has resulted from the easing of initial pandemic induced lockdowns in most of the world. Meanwhile, fuel prices have eased a bit in June and July as a result of changes in oil supply chains. The U.S. Energy Information Administration (EIA) estimates that oil prices will remain around $90 per barrel through 2023. Oil prices were about $60 per barrel prior to the pandemic.

Sources: U.S. Energy Information Administration, Short-Term Energy Outlook, July 2022, CME Group, Bloomberg, L.P., and Refinitiv an LSEG Business

What’s Next? Travel Outlook and Thought Leadership (Future)

The future is full of unknowns – we do not know for certain if international travel will rebound next year or if domestic demand will continue on a growth trajectory. It is uncertain if today’s emerging technologies will be tomorrow’s success stories or failures. However, this has never stopped L&B, global aviation industry experts, from using our diverse expertise and experience to evaluate challenges/obstacles and provide our readers with our best assessment of how we believe the future will evolve.

“We take traffic and industry forecasting seriously at L&B and put a lot of energy into getting it right. We recognize that it is a combination of art and science. The pandemic upended how industry traditionally developed forecasts. L&B worked closely with our clients to develop new methods that didn’t rely as much on historical trends to develop potential future scenarios to support complex business decisions.”

Rob Adams, President

Travel Outlook for the Remainder of 2022

North Atlantic travel has fully recovered driven by strong leisure demand. The seasonal travel drops off that normally occur in late August and into September will likely be larger than normal due to continued weaker than 2019 business travel demand. Business travel is also recovering, but at a slower pace than leisure travel due to continued use of teleconferencing technology as a replacement for some discretionary travel.

The biggest threats to a full recovery of travel volumes are a lack of staff at airlines worldwide and notably at European airports. Rebuilding staffing from pandemic induced early retirements and layoffs is taking longer than expected due to a shrinking pool of labor that is slowing economic growth in Europe and North America. Recovery of U.S. travel demand has leveled off in May, June and the first half of July due to continuing staffing shortages. Some European airports (most notably London Heathrow) have asked their airlines to voluntarily limit ticket sales and flights because they do not have sufficient staff to handle ground handling services.

Asian international travel outside of China will continue to recover, but the size of the Chinese market compared to others will continue to prevent a substantial recovery of full demand until China eases their ZeroCOVID policies. U.S. Ambassador to China, Nicholas Burns, said in an online Brookings Institution event on June 16 that he expected China to keep its ZeroCovid policy in place until “the beginning months of 2023,” based on signals from the Chinese government.5 Nicholas Brooks, Head of Economic and Investment Research at ICG, expects China will lift its Zero COVID policy “…by Q4 2022, or potentially earlier for a couple of reasons. The first is it is estimated that at the current rate China is administering inoculations, by about September 2022 around 90% of the elderly population will have completed the full three-does vaccination course…If, in addition, substantial stocks of antivirals are built, the government may feel more confident about easing containment policies.”6 Based on this statement and past policies, L&B does not anticipate China’s domestic air travel market to fully recover until the first quarter 2023, and international travel could start recovery in the second quarter of 2023.

Outlook for 2023 and Beyond

The Organization for Economic Co-operation and Development (OECD) outlook for economic growth in 2022 shows U.S. gross domestic product (GDP) growing 2.5% in 2022 and 1.5% in 2023. This is a considerable slowdown from the 5.7% growth experienced in 2021. In contrast, the U.S. Congressional Budget Office (CBO) outlook is for U.S. Real GDP to grow by 3.8% in 2022, 2.8% in 2023, and 1.5% in 2024. The long-term trend for U.S. Real GDP growth is about 1.8%. The U.S. CBO shows economic growth returning to its long-term growth trend in 2025 and 2026. Both the OECD and U.S. CBO forecasts show the U.S. economy entering a mild recessionary phase – with economic growth falling below its long-term growth rate trend either in 2023 per the OECD, or in 2024 per the U.S. CBO.

A mild recession, combined with higher prices for air travel (induced by higher labor and fuel costs), indicates that air travel demand in the U.S. could start to decline once the industry accommodates pent-up demand caused by pandemic lockdowns and travel restrictions. Airlines will have to maintain capacity discipline in order to have a profitable 2023. Achieving full 2019 demand levels may not occur for the industry as a whole until 2024 or 2025.

“I am concerned about higher fuel prices and the observed labor shortages. They should serve as bellwether to our industry that we need to move towards alternative fuels and embrace automation to make aviation more resilient. In common with other areas of the economy (and life) we are seeing these moves happening; the question remains how fast can we all move towards that more resilient future.”

Rob Adams, President

Source: Landrum & Brown

Areas of Innovation and Thought Leadership

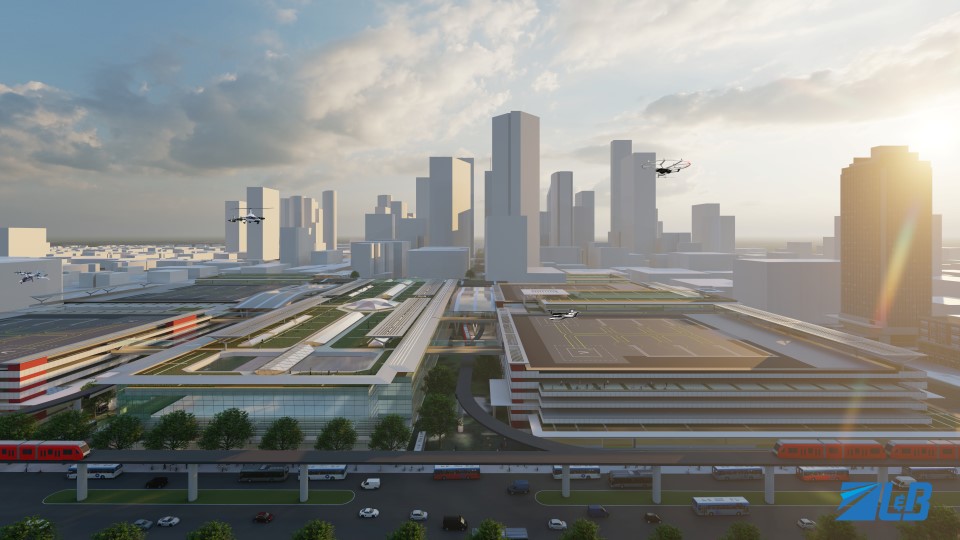

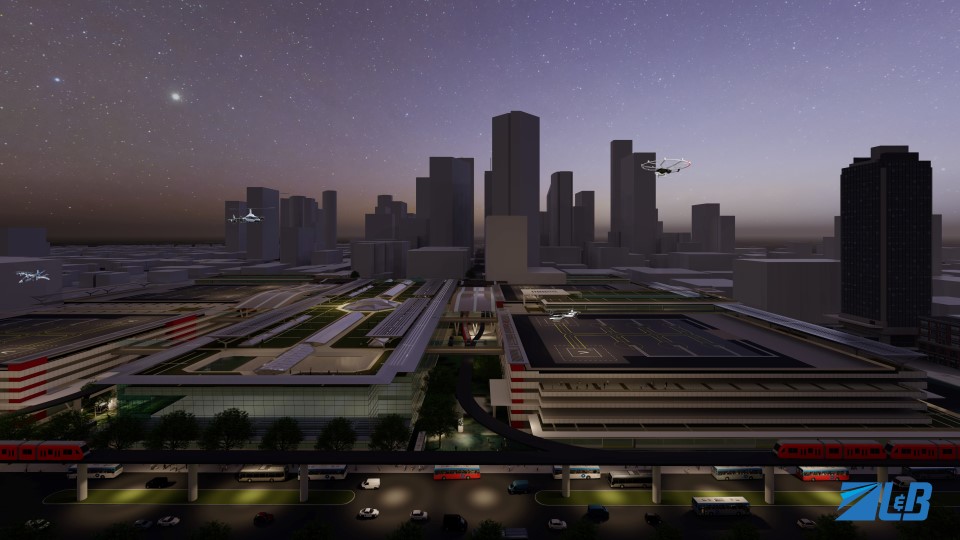

This is an exciting time to be in the aviation industry. There is so much change underway not only in aviation but in other industries and society as a whole. We see two big innovations driving much of the change in the aviation industry over the coming decades – greater levels of automation and new emerging modes of aviation (i.e. AAM). This will be coupled with a more urgent need to address and adapt to of our changing climate and an aging population. To this end, we wanted to preview some of the topics that the L&B LAB will be exploring in the areas of thought leadership over the coming months and years:

Advanced Air Mobility (AAM): Previous L&B LABs explored issue such as airside/vertiport issues, noise and the challenges facing this emerging mode. L&B will continue to explore this new mode of travel and the impacts to aviation and further incorporate AAM into our research to better understand its viability as a service and its interplay with airports.

Energy Transition: Globally, L&B recognizes the importance of our role in being thought leaders in aviation for Environmental Social and Corporate Governance (ESG). We see it as a critical issue that has the potential to reshape our airport and air travel. There are implications to planning, design, operations, the environment and finances.

Aging and Aviation: An issue the LAB first engaged in our May 2022 LAB and for which we believe is particularly critical to our industry. Airports will need to adapt to their customers as they age, and their mobility is impaired. The LAB will continue to focus on this issue moving forward.

Terminal Transition: We have discussed how “Wellness” plays an important role in terminal design, along with the need to address the ever-increasing distances between the curb and gate. Over the coming months, the LAB will explore the impacts of emerging technologies on terminal design.

Automation at Airports: While the LAB has touched on automation, it has not woven together the many threads of these emerging technological advancements that touch all aspects of airports. Automation at airports has the potential to change how airports operate and are designed. The LAB will take a deeper look at automation throughout the coming year, and its various applications at airports.

While this highlights some of the areas that we want to research for the upcoming year, there are likely to be additions and omissions as we progress. As always, L&B welcomes our reader’s feedback and areas of interest.

These are complicated times that will likely continue to challenge our industry, but there are also encouraging signs as well – innovation is abound in aviation – and the that will come opportunities for airports and the communities airports serve.

“We don’t know exactly where our work in the LAB will take us next, but uncertainty can be the most exciting part of the journey. I am looking forward to seeing where my team and our clients take us next. The LAB gives us great opportunity to explore and develop key themes of thought leadership and allows the LAB to engage with our clients and industry in different ways.”

Rob Adams, President

1 The attacks in the United States on September 11, 2001.

2 https://www.ama-assn.org/delivering-care/public-health/how-we-will-know-when-covid-19-has-become-endemic

3 The FAA requires pilots to have 1,500 hours of flight time to even be eligible for an airline transport license. A certain portion of this flight time must include night flying and instrument flying, which means navigating by use of instruments during periods of low visibility. Pilots work up to the required flight experience through training programs, military experience and by flying on their own or for jobs that require less experience.

4 https://www.skywest.com/skywest-airline-jobs/career-guides/pilot-pathway-program

5 https://www.cnn.com/2022/06/27/asia/china-zero-covid-policy-intl/index.html

6 https://www.icgam.com/wp-content/uploads/2022/05/ICG-Economic-View-Jun-2022.pdf

What is the L&B LAB?

The LAB is Landrum & Brown’s research and development unit. Our mission is to harness decades worth of industry knowledge and expertise to develop innovative solutions that support our clients along with promoting industry thought leadership.

This document was prepared by Landrum & Brown, Inc. | [email protected]

Sign up to receive our next L&B LAB in your inbox!