Air Travel Outlook:

When Will International Travel Return?

Written by: Matthew Lee and Brian Poe of Landrum & Brown Americas

Assistance from: Mathieu DeMarchi and Andy Lee of Landrum & Brown Asia-Pacific

Table of Contents

- Introduction

- Current State of COVID-19 Pandemic

- Vaccines will Enable International Travel

- Implications for Current Air Travel

- Three Factors will Drive Agreements to Reopen Borders

- Many Country Pairs Still Shutdown

- Longer Term Recovery Prospects

- World Economy is Recovering

- Airlines Begin to Schedule International Flights

- Conclusion

- About the Authors

The first half of 2021 has finally brought some good news about the recovery of the air travel industry. Domestic air travel has largely returned in the two largest domestic markets, United States (U.S.) and China, with the European Union (EU) showing recent gains. The next step in the recovery of the air travel industry is restarting international travel, which has mostly been shut down since the beginning of the pandemic. This article examines the current state of the pandemic, the progress made to combat the virus, solutions necessary to restore international air travel markets, and project when restoration might occur.

Current State of COVID-19 Pandemic

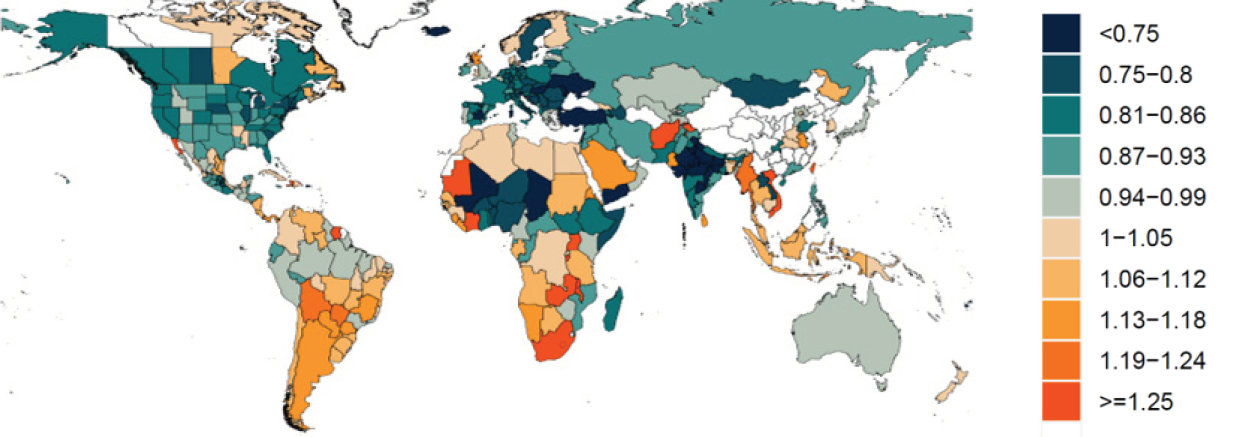

While substantial hot spots remain, the pandemic is finally ebbing in much of the world. Case rates in many countries are below 60 per 100,000 population. But more importantly, the value of “R” (epidemical rate), which indicates the rate of change for the pandemic, is less than one, signifying that case rates are declining. Two areas of the world remain a concern.

First, is South America, where case rates remain high and R is greater than one. Second, is Africa and parts of the Middle East and Southeast Asia, where case rates are more moderate, and R values vary widely.

As the pandemic rages on in many parts of the world, the probability of virus mutations increases. The Delta mutation of COVID19 has reversed progress made in battling the pandemic, especially in countries where vaccination rates lag. Preliminary data suggests that mutations have made some of the current vaccines less effective, partially negating the progress made in battling the pandemic. Mutations can reduce the effectiveness of the vaccines, which increases needs to modify them in a manner that improves their efficacy.

Vaccines will Enable International Travel

Reaching a level of international travel demand that is closer to 2019 volumes will require substantial portions of the global population to be fully vaccinated.

Vaccinated status does not guarantee that a person will not have or transmit the virus. Rather, the goal of a vaccine is to make catching the virus a minor irritation versus a life-threatening event. Vaccinations do not preclude the need for testing. However, a vaccinated status combined with a negative COVID-19 test will indicate that a traveler is virus-free and can also bypass quarantines and the requirement for additional COVID-19 tests at the end of quarantine periods. Progress towards vaccination varies widely by country. This is primarily caused by the logistics of distributing vaccines, decisions made during vaccine procurement, or insufficient funding to purchase vaccines.

IMF Aid by World Region

| Asia/Pacific | $2.2 billion |

|---|---|

| Eastern Europe | $6.1 billion |

| Middle East/Central Asia | $14.3 billion |

| Sub-Sahara Africa | $19.5 billion |

| South America | $68.0 billion |

| Other Countries | $0.7 billion |

Sources: International Monetary Fund (IMF)

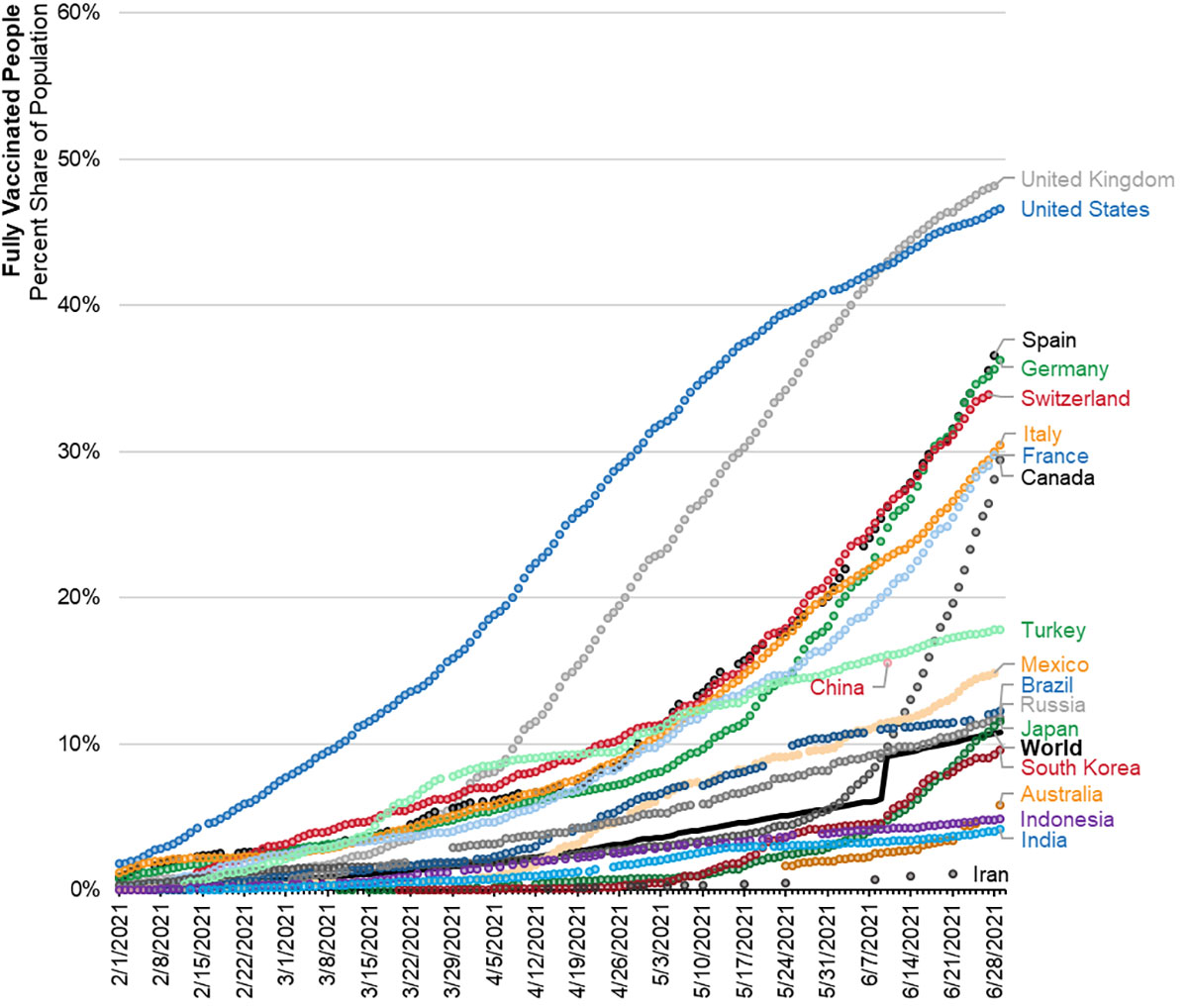

Developed Economies Vaccination Progress

Sources: Hannah Ritchie, Esteban Ortiz-Ospina, Diana Beltekian, Edouard Mathieu, Joe Hasell, Bobbie Macdonald, Charlie Giattino, Cameron Appel,Lucas Rodés-Guirao and Max Roser (2020) – “Coronavirus Pandemic (COVID-19)”. Published online at ‘https://ourworldindata.org coronavirus’

Only a few small countries have vaccinated 70 percent of their populations, which is a level that provides assurance that the virus will no longer be able to replicate – ending the pandemic.

Based on the most recent and best publicly available data, many developed countries have vaccinated less than 25 percent of their populations. However, many of these countries finally appear to be making rapid progress. Countries in Western Europe have started to accelerate their vaccination rates. China, after a slow start, is now delivering 17 million shots per day. However, the rest of the world is delivering vaccines at a slower pace. As a result, current worldwide vaccination progress stands at 11 percent.

While the U.S. and United Kingdom (UK) are achieving relatively high vaccination rates, recent counts suggest that their progress is slowing down. The U.S. government now acknowledges that they will fall short of their goal of vaccinating at least 70 percent of their population by July 4, 2021. Several factors contribute to the slowing vaccination rates. First, only a few countries have approved some of the vaccines for use with teens over the age of 12.

Second, a U.S. survey indicated that approximately 8 percent of the population will not accept any vaccines for any reason and an additional 14 percent sometimes will refuse vaccines.

Third, a portion of the U.S. population is considered “hard to reach,” meaning that considerable effort must be made to deliver vaccines to them due to their remote locations or inability to leave work to obtain a vaccine, despite their willingness to get vaccinated.

Vaccination efforts beyond the 27 largest economies (shown in the table on the following page) mostly lag nations with greater economic resources. The International Monetary Fund (IMF) has distributed over $100 billion in aid towards vaccination efforts in less developed countries. This is mostly in the form of loan guarantees and other support.

The Group of Seven (G7) industrialized democracies at their June 2021 meeting pledged one billion vaccine doses to countries that cannot afford them. While this sounds generous, according to the World Health Organization (WHO) this donation only covers 1/10th of the need. While less developed countries do not contribute large volumes of air travel, a continuing pandemic presents the threat of a mutation that renders current vaccines ineffective, thereby stalling the current worldwide economic recovery.

Implications for Current Air Travel

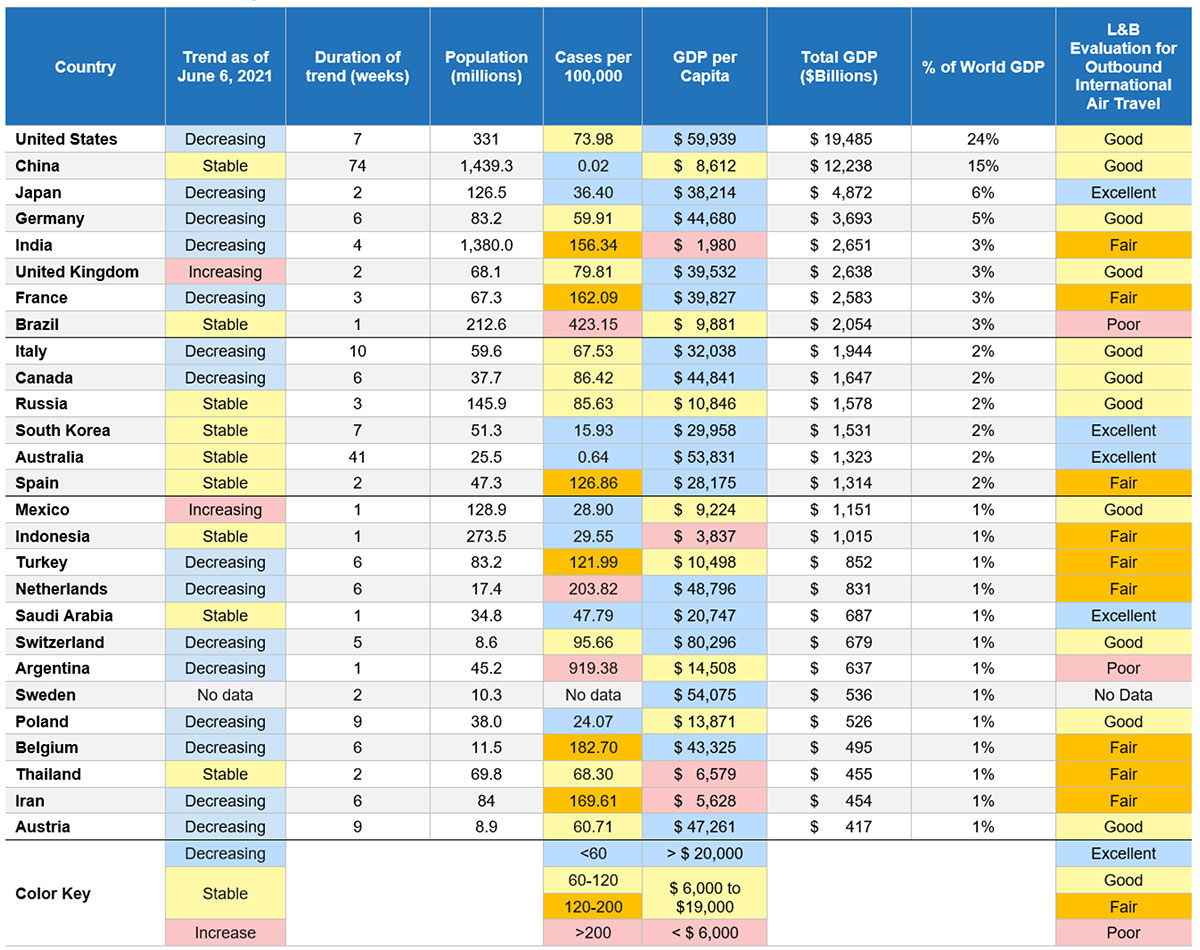

Many airlines use Gross Domestic Product (GDP) forecasts as the primary input in developing predictions of aviation demand. Countries with the largest share of World GDP also tend to have the largest share of international travelers.

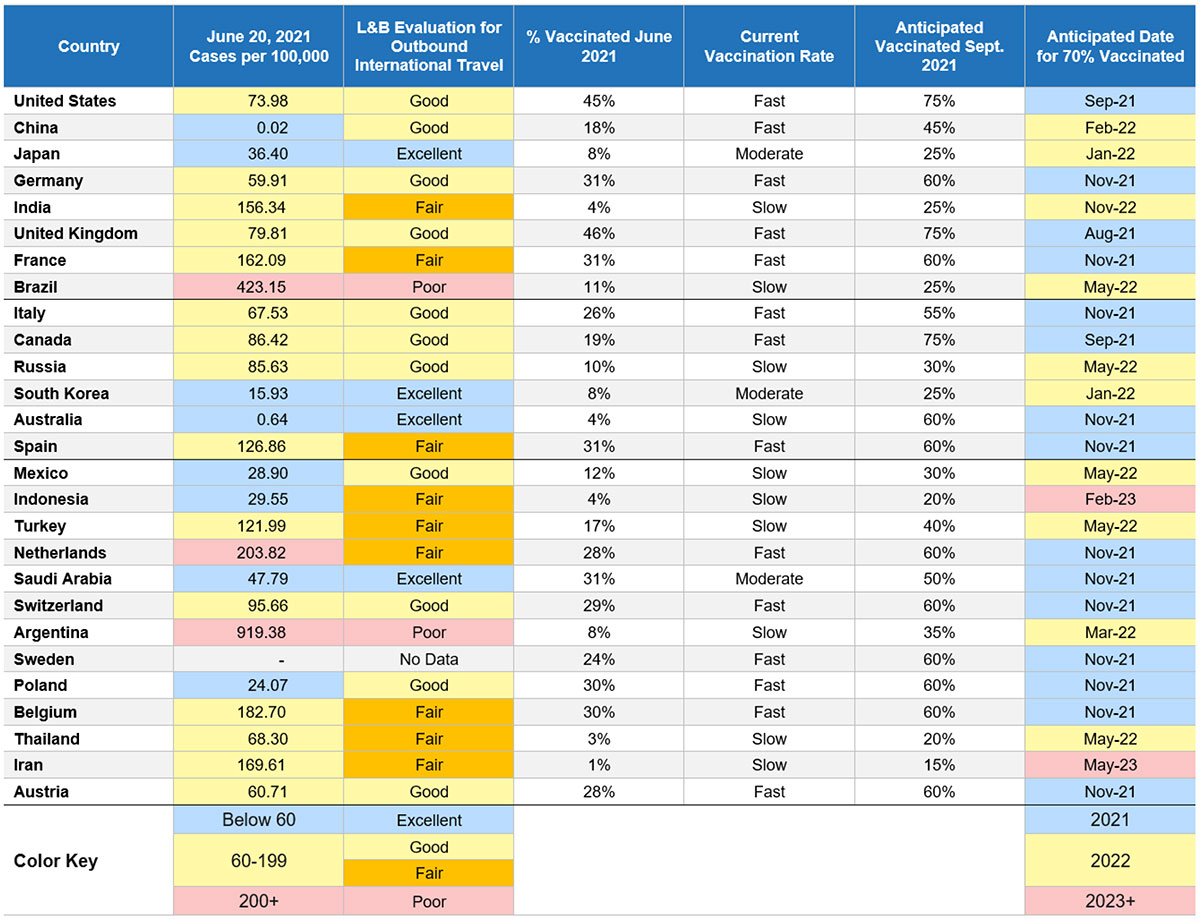

L&B’s analysis of progress made in containing the pandemic indicates that prospects appear favorable for a return of a substantial portion of international travel.

Of the eight countries with 62 percent of the World’s GDP, only Brazil has a high case rate. Only the UK is experiencing a short-term increase in cases, albeit from a relatively low case rate. The next six largest economies, each of which contribute at least 2 percent of World GDP, all have moderate or low case rates with either a decreasing or stable trend. Of the top 27 economies in the world that contribute 84 percent of World GDP, only two have high case rates or have increasing case rates. These are shown with red shading on the figure.

Pandemic Status in 27 Largest Economies with L&B Evaluation of Outbound International Travel

Sources: European Centre for Disease Prevention and Control (ECDC); The Organization for Economic Development and Cooperation (OECD) and L&B

L&B’s evaluation for outbound international travel is good to excellent for 15 of the 27 largest world economies. A good to excellent rating (shown in green or yellow on the figure) is based on having the pandemic well under control and having a moderate to high GDP per capita (higher propensity to travel by air). These 15 economies comprise 68 percent of World GDP.

Several Western European countries (France, Spain, Netherlands, Belgium, and Turkey) still have moderately high case rates, which limits their ability to participate in worldwide air travel. However, all these countries have a stable or decreasing trend and their ability to participate in worldwide air travel should improve. With this anticipated improvement, 20 of the 27 largest economies that comprise 76 percent of World GDP will have good prospects for outbound international travel in about three months.

The two largest economies of South America (Brazil and Argentina) continue to have very high case rates and no long-term trend towards improvement.

They both have current R values greater than one, which indicates that the pandemic still has the potential to increase in both countries.

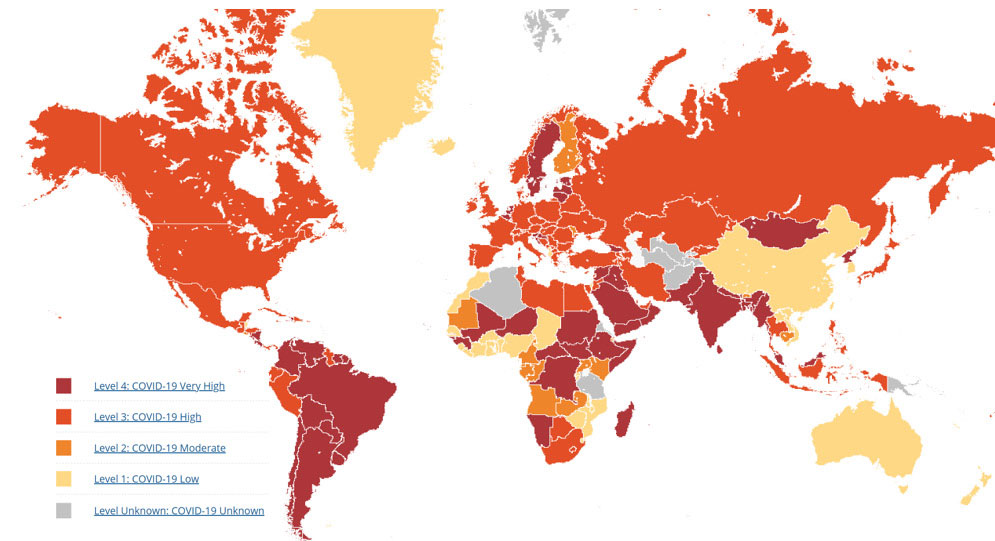

US CDC Travel Hazard Rating

Coordinated Government Actions Required for Safe International Travel

As the world’s largest source of international travelers, the U.S. government has an outsized role in determining how quickly international travel returns. The U.S. Center for Disease Control (CDC) considers much of the world as having “high” or “very high” COVID-19 case rates, where travel is either not recommended or strongly discouraged. Despite the U.S. government’s lead in developing and granting emergency use approval to three vaccines, the U.S. still does not recognize fully vaccinated status as a condition for bypassing mandatory quarantines. The EU and Canada both recognize fully vaccinated status as one of the conditions for bypassing quarantines and multiple PCR tests to confirm an infection-free status.

Government policy usually lags scientific progress and findings, which is appropriate because scientific findings usually have some uncertainty that researchers openly acknowledge.

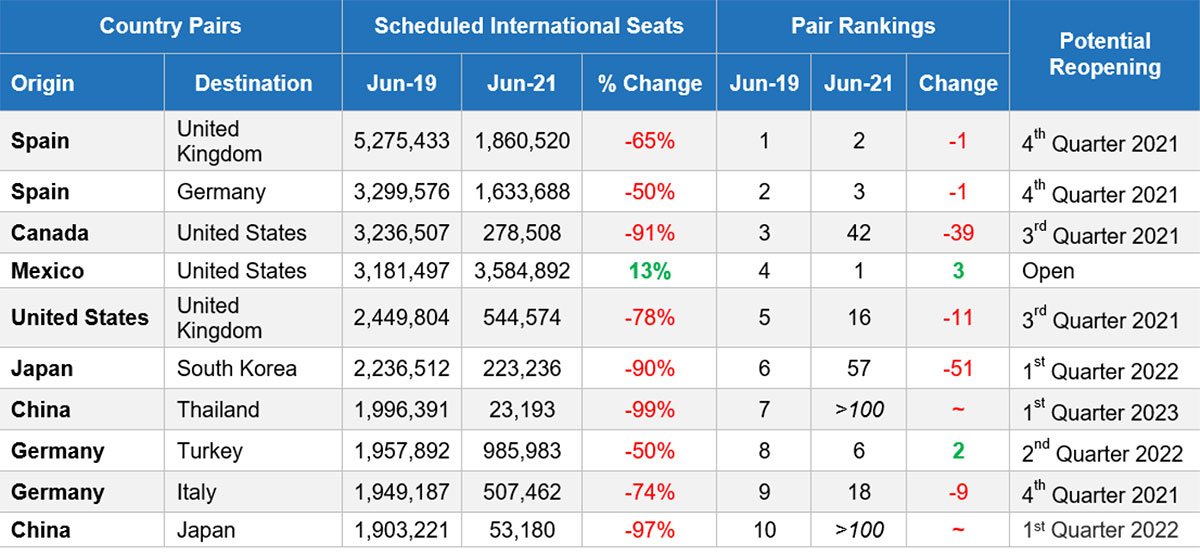

Top 10 Country to Country Air Travel Pairs

Source: DIIO Flight Database

Sound policy decisions rely on multiple studies for support. Policy is often influenced by political factors that are unrelated to their content.

Three factors will drive agreements to reopen borders for international travel:

First, countries will need to have an agreed upon worldwide list of approved vaccines. Government policies tend to favor findings from their own countries. The most relevant example is that countries will only accept vaccination status using vaccines that they approve. The lack of acceptance of vaccines approved by foreign governments may become a major stumbling block for reopening travel. The Canadian government will only accept the Moderna, Pfizer-BioNTech, AstraZeneca, and Jannsen (Johnson & Johnson) for travel. The U.S will accept any vaccine approved by the World Health Organization (WHO).

Many countries in the world, including major travel partners are using other vaccines, especially the vaccines from Russia and India, which WHO has not yet approved. The WHO has given the two Chinese vaccines (Sinovac and Sinopharm) emergency use approval in addition to the four vaccines approved by Canada. Even with agreed upon vaccines, countries will still require COVID-19 tests to confirm uninfected status prior to travel.

However, vaccines can eliminate the requirements for COVID-19 tests after arrival, therefore, the need to quarantine has been eliminated until the second test has been accepted.

Vaccination Rates for 27 Largest Economies

Sources: European C entre for Disease Prevention and Control (ECDC), University of Washington Institute for Health Metrics Evaluation (IHME), and L&B

Second, countries have different policies that balance public health risks against the economic harm caused by lockdowns that limit virtually all travel. Some countries such as Australia and New Zealand strive to achieve zero case counts through severe domestic and international travel limits regardless of economic consequences. Others (most notably Brazil and Mexico), impose few public health measures – prefering to avoid the economic harm imposed by travel limits. Other countries such as the U.S. allow their individual States or Provinces to decide their own public health measures, and issue very few national mandates.

Third, a lack of mutual trust will slow down the reopening of borders for discretionary international travel. The two factors above generate the lack of trust. Countries tend to trust their own research and analysis of vaccines versus those conducted in another country. Additionally, countries tend favor their own approach to public health versus another country’s approach, especially if the other country has fewer public health restrictions. China and Australia, which have very strict public health measures, already have indicated that it will likely be another year before they consider opening their borders. On the other hand Mexico currently has no inbound travel restrictions.

International Travel Still Shutdown for Many Country Pairs

Most of the 2019 top-ten country pairs for international travel shown on Page 5 still have not reopened. Markets where borders are closed to visitors have traffic losses in excess of 90 percent. Mexico never imposed inbound travel restrictions and as a result many U.S. vacationers took advantage of cheap rates and their inability to travel elsewhere.

Longer Term Recovery Prospects

Most of the major countries that drive global GDP will achieve 70 percent vaccinated status by 2nd quarter of 2022, except for parts of Southeast Asia, where vaccination efforts are currently proceeding at a very slow pace. North America can achieve effective vaccination by 3rd quarter 2021. Europe can achieve effective vaccination by 4th quarter 2021 with some countries achieving this status earlier. South and Central America can achieve effective vaccination by 2nd quarter 2022. North Asia and Australia can achieve effective vaccination by 1st quarter 2022. Parts of Southeast Asia and the Middle East may not achieve effective vaccination until 2023.

Africa may need all of 2023 and part of 2024 to achieve effective vaccination. Many countries in Africa will need additional vaccination aid from the IMF and more developed nations to accelerate their vaccination progress. Even with the aid, access to some populations will be rather difficult.

The current prospects for the earliest return of a significant volume of travelers on the major over-ocean transportation corridors include:

- The North Atlantic: 4th Quarter 2021

- Americas to North Asia and Australia: 2nd Quarter 2022

- North and South America: 2nd Quarter 2022

- Europe to North Asia: 2nd Quarter 2022

- Southeast Asia to Europe and the Americas: 1st Quarter 2023

The return of these corridors along with key vacation travel markets within the Americas and Europe will return approximately 80 percent of pre-pandemic air travel. The remaining 20 percent will likely need until 2024, as it contains travel from less economically developed countries.

The greatest risk to the restart of international travel is that vaccines become ineffective against new variants of the virus and the pandemic renews itself, with some countries reclosing borders when they see any sign of new cases being imported by international travel. Thus, the return to pre-pandemic levels of international travel depends on distributing and giving vaccines faster than the virus mutates.

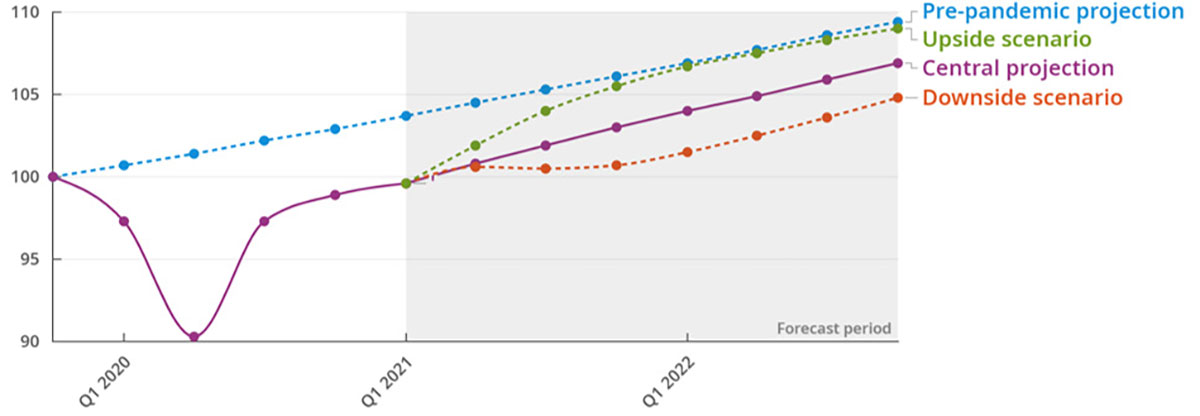

World Economy is Recovering

The economic projections from the Organization for Economic Development and Cooperation (OECD) indicate that economic growth has resumed its pre-pandemic trend. Their central projection shows this trend continuing into the first half of 2022. Their forecast acknowledges that the pandemic has delayed economic growth by approximately one year. This delay can be viewed as the permanent economic damage (destruction of wealth) caused by the pandemic.

The resumption of favorable economic trends bodes well for the ultimate return of international travel. Once air traffic recovers from the pandemic, L&B expects that worldwide air passenger forecasts will also be delayed by approximately one year. This outlook varies widely from country to country as the pandemic caused far more economic damage in some countries versus others.

The resurgence of COVID waves in several countries over the past several months has in some cases drastically changed GDP projections, resulting in more tempered GDP growth in 2021 followed by a surge in 2022. We can expect these delays in economic recovery to continue if the waves keep popping up and until vaccination is well underway and COVID is under control.

Businesses used virtual meeting technology in lieu of travel during the pandemic. It is anticipated that some virtual meetings will continue to occur because they cost less than travel.

However, a consensus is among airlines and businesses seems to indicate that most business travel, especially that associated with sales, production and project work will ultimately resume. Internal meetings funded out of company overhead are most likely to remain on-line.

Airlines Begin to Schedule International Flights

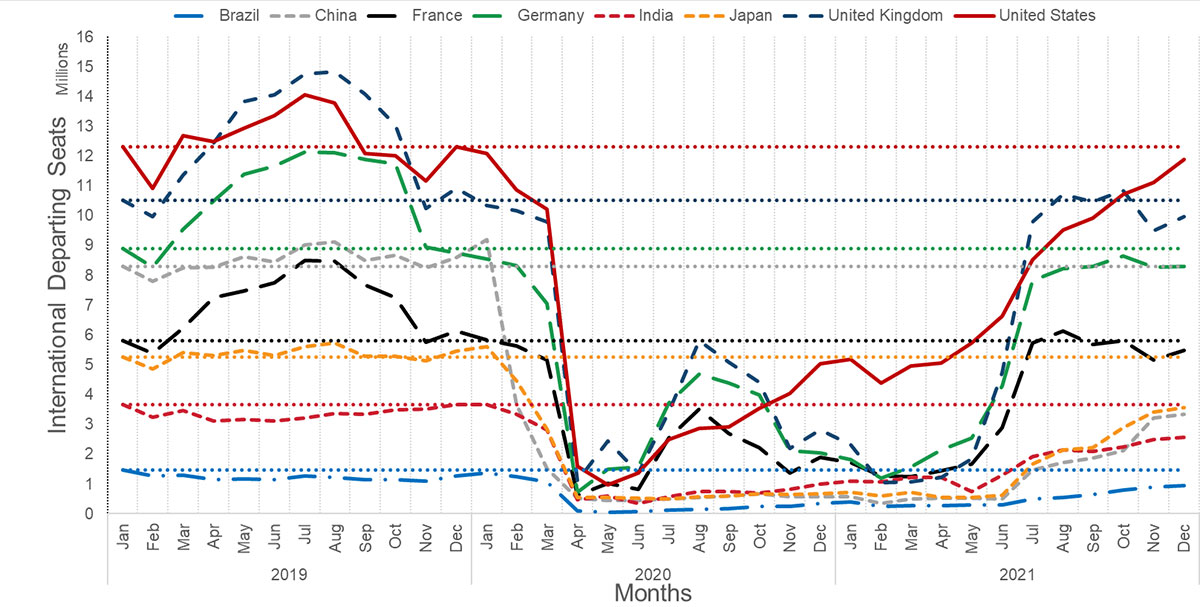

Airlines have reinstated international flights in their schedules for the second half of 2021. The largest volumes of departing seats are from the U.S., the UK and Germany, all of whom are showing 2019 seat volumes by the 4th quarter of 2021. Seat availability for the 4th quarter is still rather speculative, as carriers have rarely had consistent flight schedules for more than two months in advance during the pandemic. Additionally, actual volumes will likely fall short of what is currently scheduled.

A limiting factor for how quickly air travel returns to pre-pandemic volumes is air carrier capacity to provide the service. In the U.S., where carriers received government financial aid to retain staff, also provided incentives for staff to voluntarily retire early or leave the companies. In addition, required maintenance checks were postponed when carriers parked aircraft in long-term storage during the pandemic. With demand returning, airlines must bring on new staff and conduct deferred maintenance prior to providing service.

Outside the U.S., airlines did not receive as much government support to retain staff and stay solvent. Some carriers declared bankruptcy and must restart as much smaller airlines. Still other airlines laid off staff. They must now hire and train new staff to restore air service.

Scheduled International Departing Seats

Sources: DIIO Flight Database

Conclusion

Overall, the earliest worldwide air travel could return to 80 percent of its pre-pandemic levels is by the first quarter of 2023. The return will be led by countries with the largest and/or strongest economies, who also have had the greatest resources to support their economies during the pandemic and vaccinate their populations.

The U.S., Western Europe, Northern Asia and Australia, will likely lead the return followed by the Middle East and Southeast Asia. The remaining 20 percent of international air travel originates in less developed countries that have had few resources to support their economies during the pandemic and will need substantial outside assistance with vaccinating their populations and controlling the pandemic.

The return of international air travel depends upon the joint efforts of governments to reach agreements to open borders. These efforts rest on countries addressing three major efforts:

- Agree to utilitze a list of approved vaccines

- Reach consensus policies that balance between public health protection and economic growth

- Establish mutual trust in their vaccination policies and their public health policies

Negotiating these agreements will likely not be an easy task and will most likely occur on a country pair basis.

The recovery of our world economy and international air travel rests on our success at ending the pandemic through worldwide vaccination programs. The virus continues to mutate introducing the risk of current vaccines becoming less effective, thereby negating the some of the progress made in battling the pandemic. Each wave of the pandemic also further delays the recovery of GDP in the locations where waves take place. The world economy and international air travel hinge on the successful global distribution of the vaccine to countries that are struggling to vaccinate their populations.

1 Matt Motta, Timothy Callaghan, Steven Sylvester & Kristin Lunz-Trujillo (2021) Identifying the prevalence, correlates, and policy consequences of anti-vaccine social identity, Politics, Groups, and Identities, DOI: 10.1080/21565503.2021.1932528

What is the L&B LAB?

The LAB is Landrum & Brown’s research and development unit. Our mission is to harness decades worth of industry knowledge and expertise to develop innovative solutions that support our clients along with promoting industry thought leadership.

This document was prepared by Landrum & Brown, Inc. | [email protected]

Sign up to receive our next L&B LAB in your inbox!