The Pandemic and Air Cargo

Challenges and Opportunities

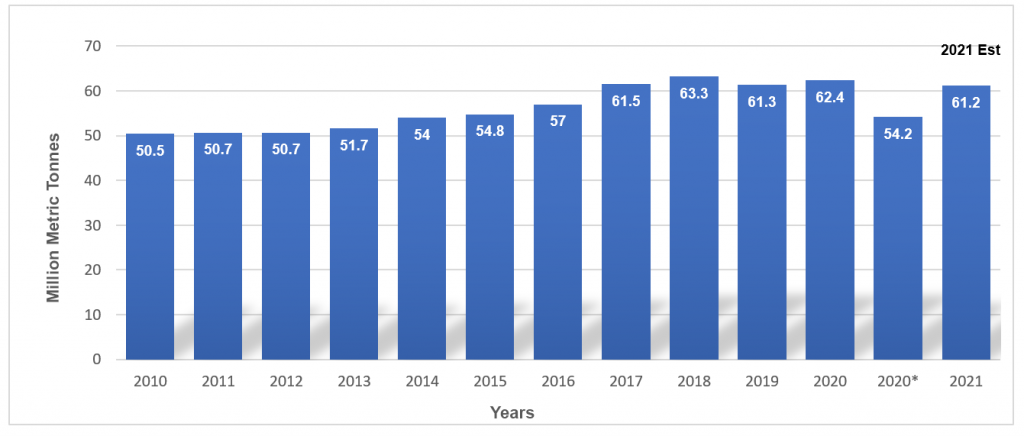

The air cargo industry plays an essential role in the multi-trillion-dollar, global logistics system. This system is also intertwined with the air passenger industry, sharing facilities, and equipment. The decline in passenger travel caused by the global pandemic had a direct impact on the air cargo system due to its reliance on the belly space on those passenger aircraft. As of last year, approximately 60% of air cargo was transported in passenger aircraft bellies. As airlines cut their schedules and grounded substantial portions of their fleets, the ability to accommodate pre-COVID volumes was eroded. Statista has estimated a reduction in global cargo volume, by weight, of 13% over the prior year. They have also forecasted that global air cargo demand should return in 2021, just below 2019 levels.

Global Cargo Volume (Weight) – 2010 to 2020 with 2021 Estimate

Source: Statista 2020

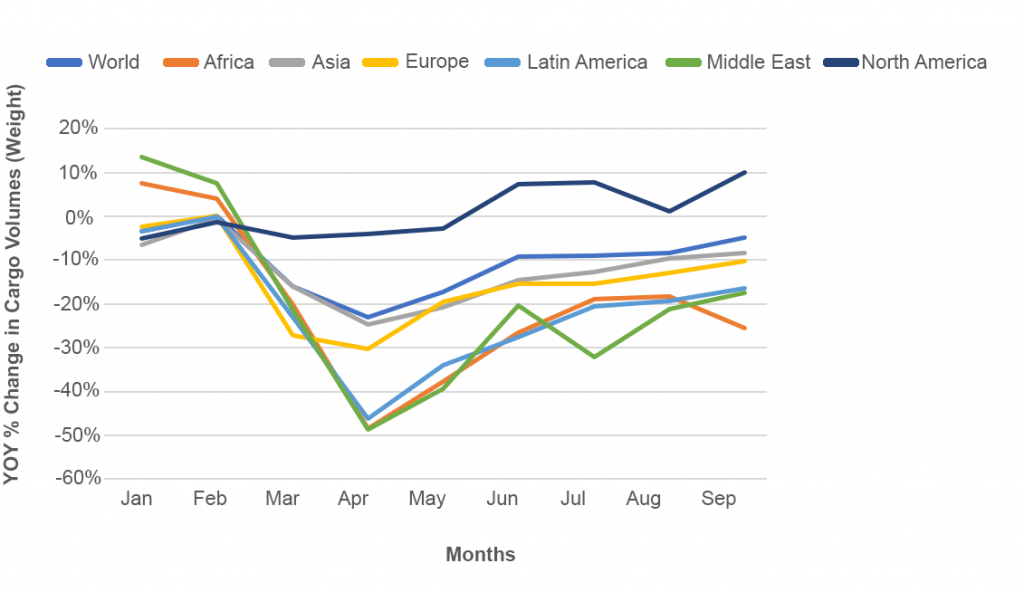

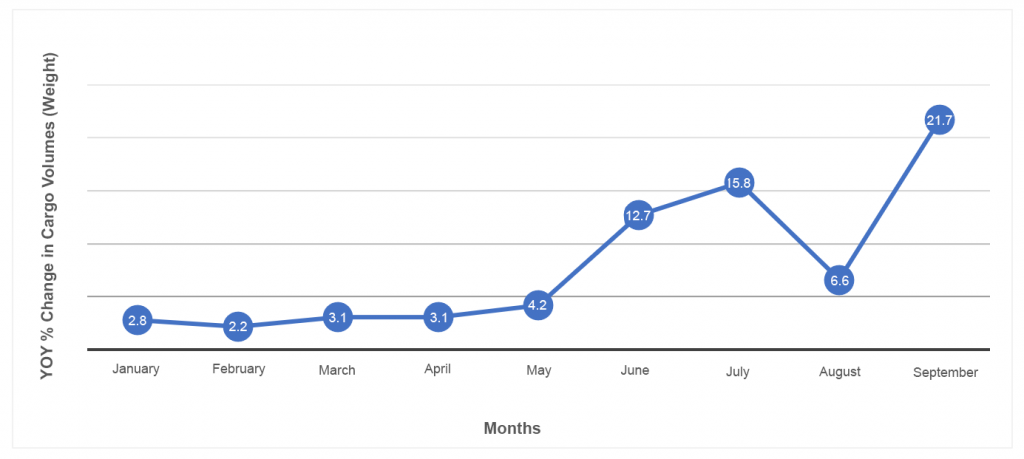

Cargo volume estimates are very similar for most regions of the world, including Africa, Asia Pacific, Europe, Latin America, and the Middle East. North America is the exception. While the U.S. market has seen declines in domestic and international passenger traffic that is similar if not worse than other major regional markets, its domestic air cargo volumes have increased over pre-COVID levels. In fact, the increase has only accelerated as the crisis has unfolded throughout the country – with a 3.1% increase in early months of March and April and more recently a 22% increase in September.

Global Cargo Volume (Weight) by Region – 2020 vs. 2019 – January to September

Source: ACI Water

Domestic U.S Air Cargo % Volume (Weight) Increase – 2019 vs. 2020

Source: BTS T-100

Why is the U.S. Air Cargo Sector so Resilient During COVID?

The reasons for the U.S. air cargo industry’s resilience during the pandemic are multi-faceted. While there does not seem to be one factor to explain the strength of the market, the maturity of e-commerce and the proliferation of big-box stores appears to have played a major role. The U.S. is home to eight out of the top fifteen, by revenues, global e-commerce companies. Amazon is the largest company on the list with $90 billion in revenues in 2020. The number of distribution centers the company has in the U.S., which numbers in the hundreds, dwarfs the facilities they have in other countries. Other major e-commerce companies such as Target, Best Buy, Walmart, Macy’s, Costco, eBay, and Wayfair all have massive distribution networks in the U.S. Most also have brick and mortar big box retail locations, which have also served as de facto warehouse/distribution centers as in-person shopping has been discouraged or prohibited during the pandemic.

Another driver for the increased U.S. volume was the influx of home electronics. An unprecedented number of people developed home offices for the first time due to offices being shut down. Many people upgraded their existing systems to be able to handle new software platforms for communications with their offices and clients. Finally, air cargo was also used to reduce the time to market for critical medical supplies, such as Personal Protective Equipment (PPE), and to restock essential goods that were in high demand due to slowdown in global manufacturing that occurred in Q1/Q2 of 2020.

These three drivers of demand enabled e-commence to show a year-over-year growth of 129% as of November 2020, and it is anticipated that it will account for 14% of the entire retail industry in 2020 – the largest single year increase ever recorded.

Air Cargo, Contributing to Cure

While it is well-known that aircraft facilitated the more rapid spread of the virus around the globe, aircraft will also play an essential role in delivering the cure. Over 10 billion doses have been pre-ordered to vaccinate a global population of 7.8 billion. The weight of all the doses equates to 65,000 metric tons. IATA has estimated that approximately one-million doses will fit on a B-777F. This would translate to at least 10,000 flights to just deliver the vaccine -assuming that all vaccines will be transported by air, which will not be the case. In reality, this will still equate to thousands of flights since many of the aircraft used will be smaller and additional flights will be needed to provide medical supplies to support the vaccination effort (i.e. syringes, gauze, alcohol swabs, etc.).

There are various forms of the vaccine made by many different companies (AstraZeneca, BioNTech, GlaxoSmithKline, Johnson & Johnson, Merck, Moderna, Novavax, Pfizer, and Sanofi, to name a few) and each has different requirements. Some, such as Moderna and BioNTech, require specialized cold storage. All vaccines will be a security concern since they are so valuable, requiring air cargo carriers to increase their vigilance. In places with increased air cargo demand like the U.S., this adds additional pressure to carriers requiring them to increase their capacity where possible but to more importantly manage demand.

Challenges & Opportunities

The capacity of the air cargo system in the U.S. prior to the pandemic was constrained. Air cargo carriers responded to the surge in demand driven by the crisis by hiring new employees. For example, to respond to a 21% surge in package volume in the second quarter of 2020, UPS hired 39,000 additional employees. The firm also hired 100,000 additional temporary employees during the holidays and will convert nearly 35% of these new hires to full-time status. However, it is not practical to always increase the capacity to fully respond to potentially short-term surges in demand. UPS and other carriers have also enacted measures to manage demand, some of these actions include:

- Shifting volume to less congested days, fully utilizing weekends and off-peak time of the day

- Imposing surcharges for home deliveries to deter low yield volume

- Placing shipping limits on large

The air cargo business is a sprawling industry providing the movement of goods locally, nationally, and internationally. As the world has experienced during this pandemic, the requirement to move every type of good has become vitally important. While the pandemic did not necessarily create new opportunities for airports, it brought to light the overlap of already-growing life sciences demand with e-commerce demand and also highlighted the need for surge capacity/ flexibility to respond to a crisis of this extent.

Air cargo carriers were used to rapidly deliver critical medical supplies and to support an accelerated recovery of the supply chain from a slowdown in goods production caused by the pandemic. Consequently, airports should revaluate cargo development and its operation at their facilities based on the heightened criticality of the role that the air cargo industry plays in keeping the economy running in both good times and bad.

For example, airports should look to review their carrier lease agreements to ensure they have the flexibility needed for ramp/apron parking. The increase in cargo only flights during the pandemic showed the need for the airports to be able to control their facilities for the most efficient operations during high demand times or events. As we look to the future, consumer buying habits will likely be permanently changing towards more e-commerce and less brick and mortar. This change should be slow enough for the air cargo industry to react, as it is anticipated that the industry will return to 2-3% annual growth rate that has historically occurred. Airports will play a critical role in supporting this growth. The pandemic has further demonstrated that air cargo is essential component of our freight/logistics system; moving forward airports and the air cargo industry must continue to work together to foster its capabilities and growth.

Contributors: Written by Kevin Hoffmann and Richard Barone with LJ Marciano

Portable Vaccine