Getting International Travel Back to Normal

Our Pathway to the New Normal and What it Could Look Like

The world is now ten months deep into the COVID-19 pandemic. While we can foresee its end due to the emergence of several promising vaccines, our road to recovery is by no means certain. Each individual country has varying tasks of managing public health and establishing networks to efficiently distribute vaccines.

Any one country can resume unrestricted domestic travel after controlling the pandemic within its borders. Several, notably China and New Zealand, have already returned to more normal levels of domestic air travel. They accomplished this by eliminating cases through stringent public health measures. Nations can also achieve this through herd immunity – a combination of immunity gained by having the illness and a vaccination program.

Countries will achieve control over the pandemic at different times based on how capable they are in managing public health mitigation measures and distributing the vaccine. Resuming international travel between pairs of countries risks reintroducing COVID-19 if only one of the nations has fully controlled the pandemic. Until countries achieve herd immunity, they must request proof of vaccination or use highly reliable screening methods that identify and quarantine infected persons.

With the approval and distribution of vaccines, nations will gain an additional health screening tool in addition to the various testing and quarantine methods they currently use. The available screening methods to monitor arriving travelers will include the following:

- Proof of vaccination will emerge as the best method to demonstrate a traveler’s infection free status. One airline has already indicated that they will require proof of vaccination as a condition of boarding an international flight. Countries and airlines will need to develop systems where passengers can easily identify themselves as having the vaccination. The airlines and countries will have to agree upon which vaccines they will accept. Current United States CDC guidance states that a previous infection only demonstrates 90 days of immunity. Additional research is necessary to determine how long vaccines provide immunity. Proof of prior infection in lieu of a vaccine is unlikely to become a basis of demonstrating infection free status.

- Testing of arriving passengers has been embraced by many airlines as sufficient proof that a traveler is infection free. However, many public health authorities have not accepted negative tests as sufficient proof because of the unreliability of tests in detecting infections during the early stages of the disease.

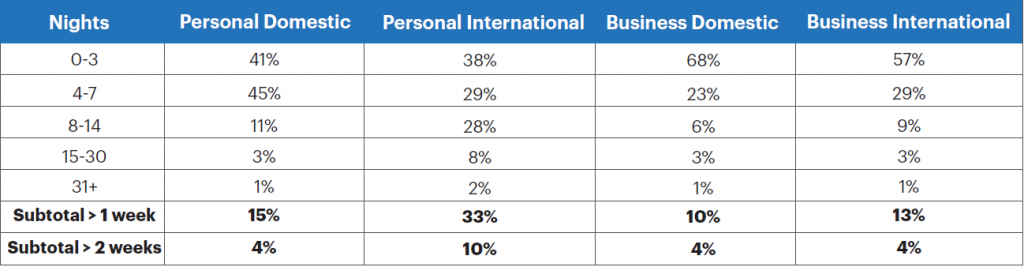

- Quarantines for all arriving passengers is the current default mode of many countries to assure that arriving passengers do not spread the pandemic to their uninfected populations. These quarantines periods vary from 10 to 14 days. Most trips are shorter than 14 days. Thus, quarantines preclude most travel.

- Combinations or quarantines and testing have been used by some countries to shorten the quarantine period to as little as five to seven days. Travelers must test negative within three days of departure and must test again five days after arrival. The first negative test enables the trip while the second negative test ends the quarantine. Shortening the quarantine by a week enables more trips, but the length of the quarantine is still longer than most trips.

Quarantines of any length effectively preclude most travel. So far, proof of vaccination appears to be the only method that will bypass quarantine requirements. Further research and government approvals are necessary to create a reliable test that public health managers will accept to bypass quarantines.

How Many Nights Did You Stay at Your Destination?

Source: Ipsos survey of American adults (January 2018) accessed through www.airlines.org

Travel Bubbles – Bridges to Trusted Partners

Travel Bubbles are a promising strategy that could help restore international air travel in the short to near-term. These agreements define the public health screening requirements between two or more countries in a region. Most of these bubbles are between nations that have controlled their level of infection and are currently not experiencing an outbreak. Agreements typically require passengers to:

- Have entry permits to enter countries by providing additional personal and health information prior to leaving their home country.

- Provide a negative test prior to boarding their aircraft and/or a second test on arrival.

- Wear face masks on the flight.

- Download a tracing app prior to travel.

- Provide proof of residency in the country of origin (passengers must be in origin country for a specified amount of time – months or years – before traveling).

Travel Bubbles are starting to form across Asia where countries are further along in their recovery than the rest of the world. As pairs of countries achieve herd immunity through vaccination programs or have extended periods of proven public health management, travel bubbles are an attractive means for restarting meaningful volumes of international air travel. The Asian experience also shows that starting bubbles based solely on public health management provides only a fragile restart of travel. The start of several Asian bubbles such as Hong Kong to Singapore have been delayed because of renewed outbreaks of the virus.

Defining the New Normal

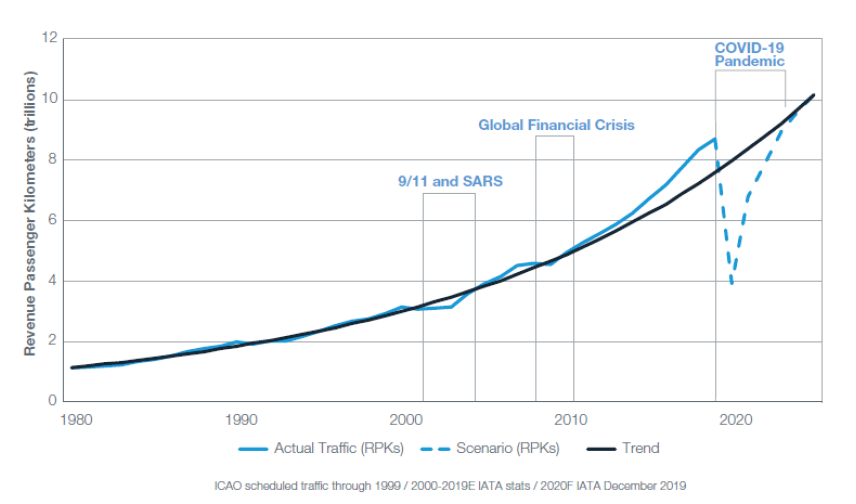

One of the biggest unanswered questions in the aviation industry is, “when will our airports return to 2019 travel demand?” This question presupposes that 2019 was our last normal year, but it was in fact well above a normally busy travel year. Families and businesses had more discretionary cash to allow them to spend more on travel.

As we look towards the post-pandemic future, the Boeing forecasts align with most other industry forecasts. These forecasts all indicate that it will take three or more years for demand to return to 2019 levels and five or more years to return to its prior long-term trend. Thus, getting travel back to normal is really returning to the long-term trend and not to the level of demand that the industry was experiencing prior the outbreak of the pandemic.

Boeing Analysis of Long-Term and Short-Term Future Growth of Aviation

Even when demand returns, the elements that drive air passenger demand will likely be different than in the past. The pandemic accelerated two economic trends that were present before this global crisis. The first is the use of video conferencing in place of air travel, which has exploded in the COVID-19 world. Second, e-commerce with home delivery services was already experiencing rapid growth, which has only expanded during the pandemic.

Videoconferencing

The new temporary normal of business travel has been defined by the initial lock-down phases of the pandemic that forced many white-collar employees to work from home and avoid business travel. Use of teleconferencing software exploded as in-person meetings suddenly went on-line. We quickly adapted our living spaces to include home offices. As the pandemic wears on, many nations’ work forces have become even more accustomed to these new arrangements.

Business travel continues to be limited and most of the people flying now are low-fare leisure travelers. Ed Bastian, the CEO of Delta Air Lines recently stated that, “business travel is down 85% but that most corporate customers are putting at least a few employees back in the air.” Bastian also added, “video technology might replace some trips, and there could be a 10% to 20% drop in the next couple of years when we get to that new normal of business travel.” Interestingly China is bucking that trend with widespread business travel returning quickly once restrictions were eased.

Worldwide, there may indeed be some elements of business travel that will not return once the pandemic is under control because the workforce has become more accustomed to working with colleagues remotely through video conferencing and workplace chat platforms. Depending on the state of the economy and air fares, the standard for what warrants a business trip may change as companies recognize that collaborative work can be done remotely. Conversely, some business travel could increase as more employees choose to live in a different city than their employer, resulting in the need to commute by air travel to the office when in-person collaboration is needed.

The Return on Investment of U.S. Business Travel, Oxford Economics USA, September 2009.

https://ftnnews.com/tours/40518-gbta-poll-reveals-impact-of-covid-19-on-business-travel, October 22, 2020

E-Commerce

In contrast to passenger traffic, air cargo weights are up industry-wide due in part to the shift to e-commerce. According to the Bureau of Transportation Statistics, cargo weight, systemwide (domestic and international) is up 3.1% YTD, over 2019. For domestic only cargo, 2020 cargo weight is up 6.5% YTD over 2019. UPS CEO Carol Tomé stated, “Domestic volume was up nearly 14% year over year in the third quarter of 2020.” The longer the pandemic lasts, the longer customers will have to acclimate to the convenience of home delivery versus in-store shopping. E-commerce was already transforming restaurant and retail businesses prior to the pandemic. Restaurants were seeing increases in delivery orders placed through apps such as GrubHub and DoorDash, replacing some in-store dining. Retailers were seeing business shift from their stores to their websites or to Amazon, who has emerged as a major delivery service competitor to FedEx and UPS. The lockdowns during the initial phase of the pandemic resulted in a total shifting of retail to e-commerce channels. Lockdowns largely ended over the summer, but in-store business did not fully return to normal. With northern hemisphere fall (Autumn) outbreaks, some lockdowns have resumed, and e-commerce continues its strong growth. In-store Black Friday sales in the United States were lightly attended compared to past years. The rise of e-commerce has been a boon to the air cargo industry, a trend that is likely to continue.

Impact on Tourism

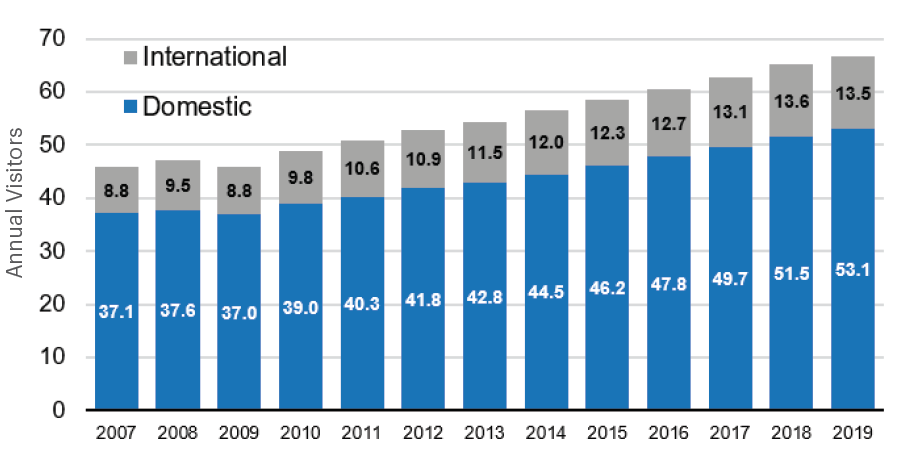

The increase in employees working from home and e-commerce has had a ripple effect on central business districts, which

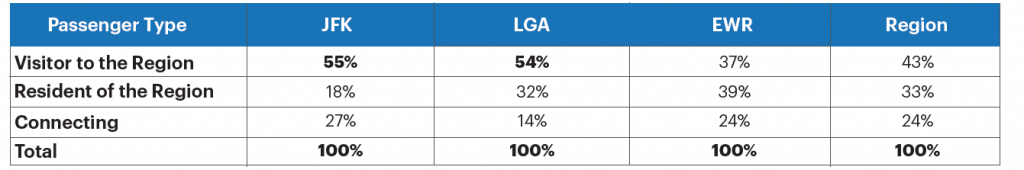

in turn can have impacts on urban tourism. Fewer employees in central business districts result in restaurants having a smaller lunch trade and fewer shoppers for retailers during lunch and after work. The increase in e-commerce could result in fewer shops and less of a need for retail space, which also reduces demand for restaurants. One of the big reasons Midtown Manhattan is the United States’ largest Tourist destination is the diversity of its retail and restaurant scene. Increasing work-from-home and e-commerce has the potential to reduce the overall attractiveness of Midtown Manhattan and other urban business districts as travel destinations. Up until 2019, urban tourism was a major generator of air travel. New York City, the U.S.’s largest tourist destination, saw its visitors increase by 44% from 2009 through 2019. Over half of the passengers using LGA and JFK were visitors to the city.

Boeing Analysis of Long-Term and Short-Term Future Growth of Aviation

Source: NYC & Company, Annual Report 2019-2020

New York Airport Passenger Types

Source: PANYNJ 2019 Annual Traffic Report

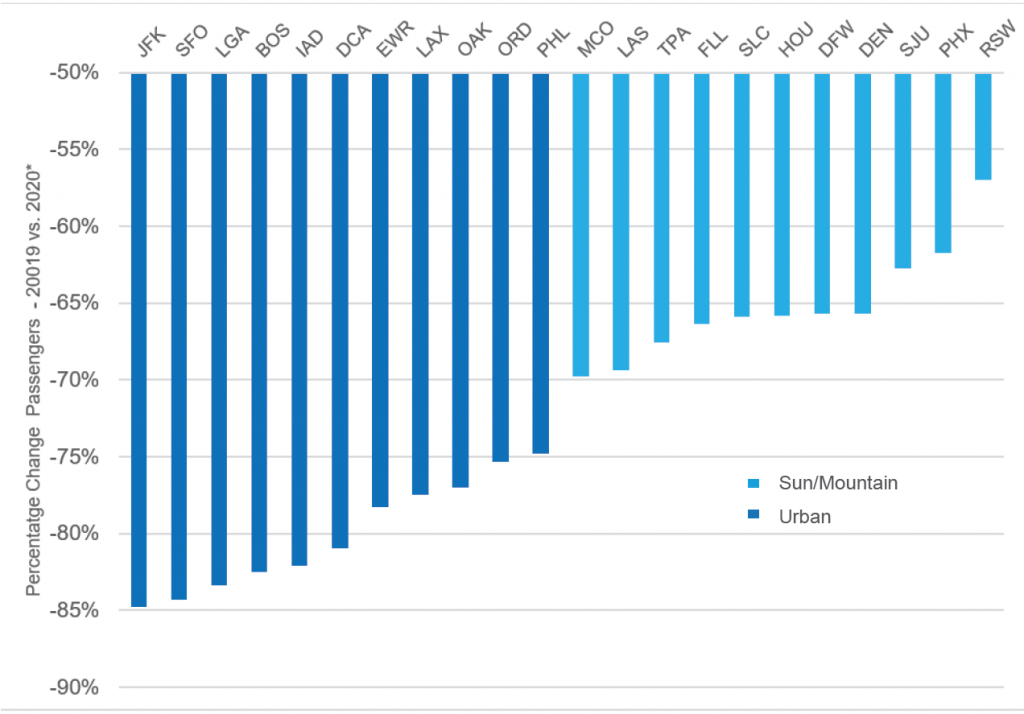

The performance of large airports throughout the U.S. appears to vary based on whether they primarily serve urban centers or sun/mountain (beach and ski resort/recreational areas) regions. U.S. airports serving traditional urban population centers such as SFO, BOS, IAD and ORD are performing far worse than those serving destinations in Florida, Texas, and the mountain west. These airports – LAS, HOU, DFW, DEN, PHX and RSW – are in some cases are operating at close to 43% of normal traffic compared to urban airports like JFK or SFO, which are only operating at around 16% of 2019 demand.

Percentage TSA Checkpoint Volume Decline: Urban vs. Sun/Mountain Large Airports – 2019 vs. 2020

Source: TSA

Notes: Data Range is 3/1 to 11/4 for 2019 and 2020

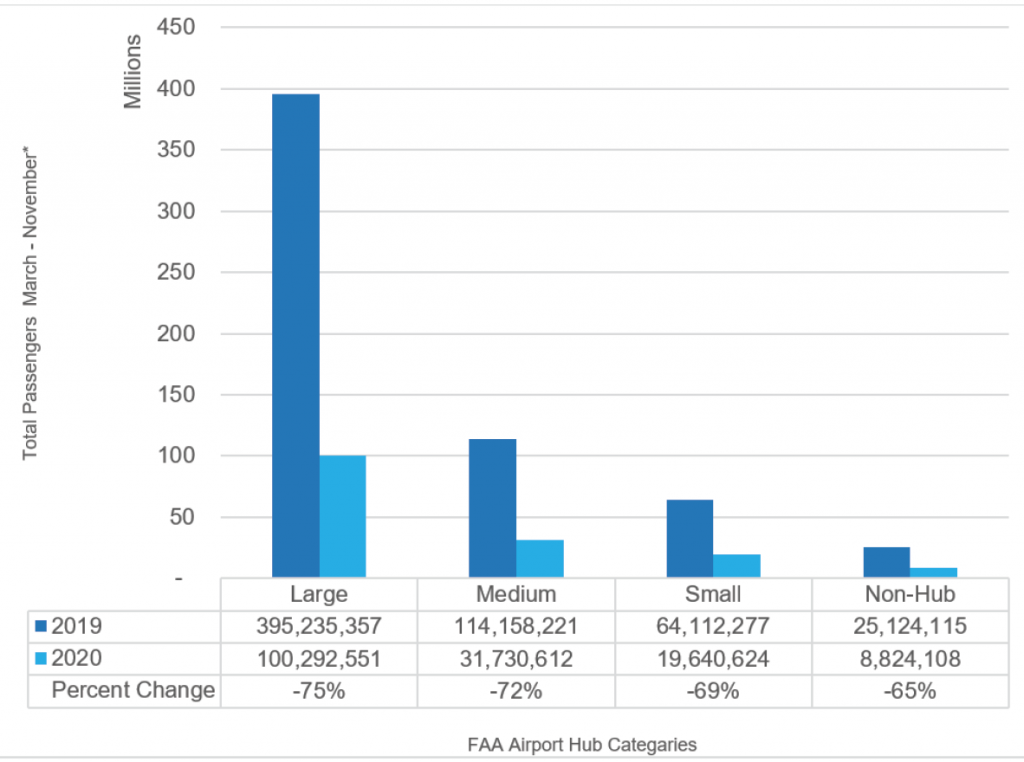

Examining the same data another way shows the dramatic drop in demand at U.S. large hubs compared to smaller hubs. These data show that smaller markets appear to be more resilient during this crisis compared to major urban centers. The changes induced by work from home and e-commerce may reduce the attractiveness of urban tourism. In response, airlines will reduce their service to large cities until demand recovers. Other leisure destinations such as beaches and theme parks will likely benefit from reductions in urban tourism.

Comparison of TSA Checkpoint Volumes by Airport Size Hub Size – 2019 vs. 2020

Source: TSA

Notes: *Data Available through November 14, 2020

Airline Networks Will Change

Airlines will alter both their service offerings and their networks in response to these changes in demand. Some, especially those that cater to leisure travel will see opportunities for growth. Others that depend more heavily on business travel may shrink or be forced to compete harder on the leisure side of the market until business travel returns. Regardless of who grows and shrinks, airline network changes will result in more intense competition that may result in lower fares over the near-term until networks reach a new level of stability that enables long-term profitability.

Contributors: Written by Matt Lee and Rich Barone with contributions from Michelle Gallo and Gary Gibb.